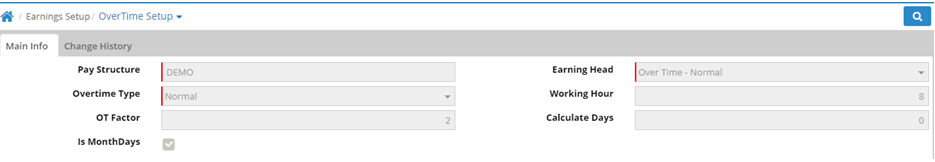

Over time setup interface is used to define how the overtime will be calculated for employees depending on Overtime type and factor. If for the same Overtime type, e.g. Normal,the overtime factors are different, then different earning heads will have to be made. The basis of overtime calculation will be determined by the formula defined in the Pay Structure Definition against the earning heads.

Pay Structure: Select Pay structure from the available list. Only those pay structures which have any earning head for overtime will be displayed.

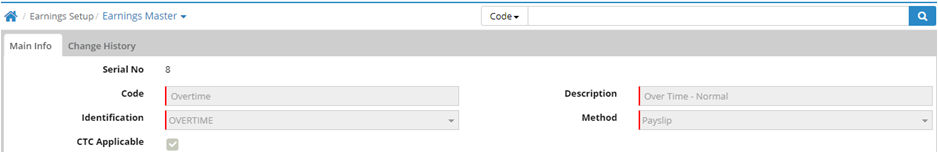

Earning Head: Select the earning heads. Only those earning heads will be displayed who have been identified as Overtime.

Overtime Factor is same for all employees with one overtime earning head

Pay Structure |

Earning Head |

OverTime Type |

OT Factor |

ABC Pay Structure |

Over Time |

Normal |

1 |

Different Overtime Factor for same overtime type with multiple Earning heads

Pay Structure |

Earning Head |

OverTime Type |

OT Factor |

ABC Pay Structure |

Over Time |

Normal |

1 |

ABC Pay Structure |

Over Time - Site |

Normal |

1.5 |

ABC Pay Structure |

Over Time - Batching |

Normal |

2 |

Different Overtime Factor for same overtime type, with different pay structure and multiple Earning heads

Pay Structure |

Earning Head |

OverTime Type |

OT Factor |

ABC Head Office |

Over Time |

Normal |

1 |

ABC Site1 |

Over Time - Site |

Normal |

1.5 |

ABC Batching Plant |

Over Time - Batching |

Normal |

2 |

Different Overtime Factor for different overtime types, with multiple Pay Structures and Earning heads

Pay Structure |

Earning Head |

OverTime Type |

OT Factor |

ABC Head Office |

Over Time - Normal |

Normal |

1 |

ABC Head Office |

Over Time - Holiday |

Holiday |

1.5 |

ABC Site1 |

Over Time - Normal |

Normal |

1.5 |

ABC Site1 |

Over Time - Production |

Production |

2 |

ABC Site1 |

Over Time - Holiday |

Holiday |

2.5 |

ABC Batching Plant |

Over Time - Normal |

Normal |

1 |

ABC Batching Plant |

Over Time - Production |

Production |

1.5 |

ABC Batching Plant |

Over Time - Holiday |

Holiday |

2 |

Overtime Type: Select Overtime type -Normal, Production or Holiday. Different calculations can be defined for each of these three types of overtime. These are descriptions given for easier association and understanding.

The combination of pay structure and earning head will determine the formula for deriving the base amount on which overtime will be calculated.

OT Base amount is calculated on the formula for earning head as defined in the pay structure (Example CTC Rs. 50000/-)

Paystructure |

Earning Head |

OverTime Type |

Formula |

OT Base Amount |

Head Office |

Over Time - Normal |

Normal |

Basic |

30000 |

Site Office |

Over Time - Holiday |

Holiday |

Basic + HRA + Conv |

50000 |

OT Factor: Give the calculation factor for overtime rate calculation. Example, 1, 1.5 or 2 times the formula as defined in the Overtime earning head.

Working Hour: Define the number of working hours as per the office policy.

Calculate Days: Give the number of days which have to be considered in the month. Example, 30 days can be considered as a month, which is irrespective of the actual number of days in a month.

Is Month Days: If checked it will consider the actual number of days in the month. So months like January, March will be considered as 31 days, April, June as 30 days, February as 28 or 29 days. If Month days is selected, it will override Calculate Days for overtime calculation.

For the same overtime calculation basis, difference in amount for calculate days and months days is shown.

OT Basis 30000 |

|||||||

Type |

Factor |

Working Hour |

Calculate Days |

Month Days |

OT Hour |

OT Amount |

|

Fixed Days Basis |

Normal |

1 |

8 |

30 |

|

25 |

3125 |

Production |

1.5 |

8 |

30 |

|

25 |

4688 |

|

Holiday |

2 |

8 |

30 |

|

25 |

6250 |

|

Month Days Basis |

Normal |

1 |

8 |

|

28 |

25 |

3348 |

Production |

1.5 |

8 |

|

31 |

25 |

4536 |

|

Holiday |

2 |

8 |

|

30 |

25 |

3250 |

|

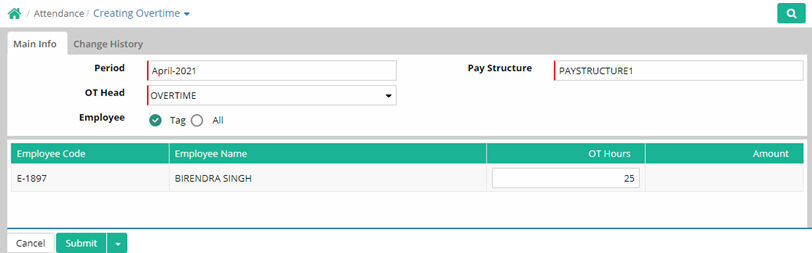

After giving all the necessary data, click on the Submit button to save the record.

Details of OverTime Calculations

For Overtime calculation the above setup is done and actual OT hours are taken from the Overtime entry form.

Description |

Earning Head Basis Changed |

Month Days Changed |

Working Hours Changed |

OT Factor Changed |

||||

CTC |

50,000 |

50,000 |

50,000 |

50,000 |

50,000 |

50,000 |

50,000 |

50,000 |

Basis |

Basic+HRA+Conv |

Basic |

Basic |

Basic |

Basic |

Basic |

Basic |

Basic |

OT Base Amount |

50,000 |

30,000 |

30,000 |

30,000 |

30,000 |

30,000 |

30,000 |

30,000 |

Month Days |

30 |

30 |

28 |

30 |

28 |

28 |

28 |

28 |

Per day OT Rate |

1,667 |

1,000 |

1,071 |

1,000 |

1,071 |

1,071 |

1,071 |

1,071 |

Working Hours |

8 |

8 |

8 |

8 |

8 |

10 |

10 |

10 |

Per Hour OT Rate -1 |

208 |

125 |

134 |

125 |

134 |

107 |

107 |

107 |

OT Factor |

1 |

1 |

1 |

1 |

1 |

1 |

1 |

2 |

Final per our OT Rate |

208 |

125 |

134 |

125 |

134 |

107 |

107 |

161 |

OT Hours in a month |

10 |

10 |

10 |

10 |

10 |

10 |

10 |

10 |

Total Calculated Amt |

2,083 |

1,250 |

1,339 |

1,250 |

1,339 |

1,071 |

1,071 |

1,607 |

During Payslip generation, the calculation basis will be picked from Overtime Setup and the actual number of hours worked will be picked up from Attendance> Overtime entry to get the overtime payable amount.

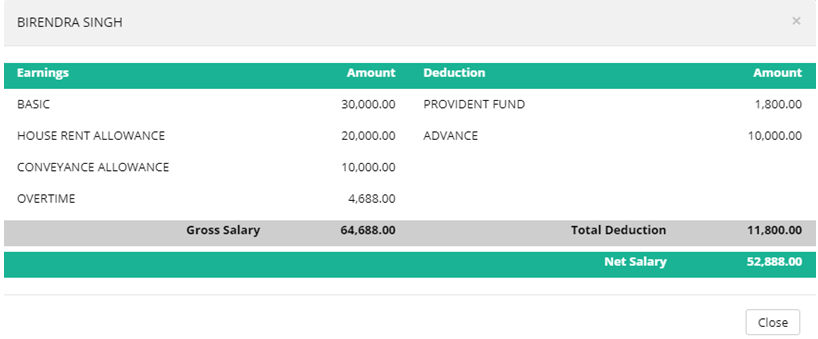

Sample payslip with overtime

© Gamut Infosystems Limited