The basis of calculations for individual earning and deduction heads are defined for the various pay structures. Pay Structure can be created at enterprise level, Company level or multiple structures under one company. Each pay structure has predefined earning and deduction heads, which will apply to all employees who fall under the selected pay structure. This does not mean that they will receive the same salary, this means that the computation process of salary will be the same. The actual salary will depend on the variable factors like CTC rates, salary days, date of joining in, the month of joining, date of resignation in, the month of leaving, etc.

Separate entries have to be done for all applicable earning and deduction heads. Example, define Basic and save the record, then HRA, and earning and deduction heads one after the other.

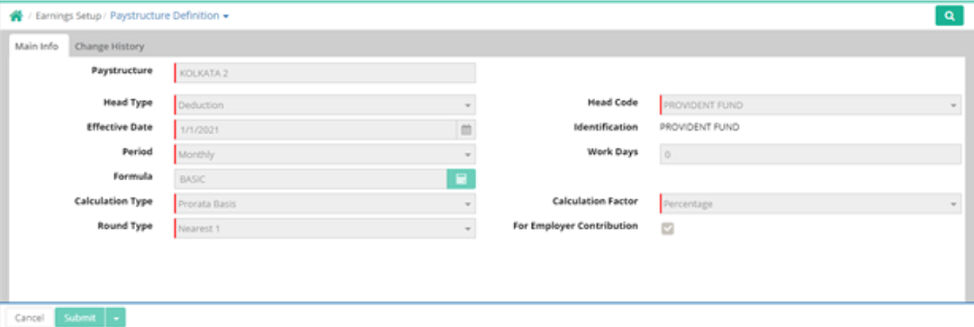

Pay Structure: Select the Pay structure which was created in the Pay Structure Master

Head Type: Select the head type Earnings or Deductions as per requirement. If Head type is selected as earning then only earning head will reflect, if head type is selected as deduction then only deduction head will reflect in the Head Code.

Head Code: Select the code for the earning or deductions head. If Head type is selected as earning then only earning head will reflect, if head type is selected as deduction then only deduction head will reflect in the Head Code.

Some of the examples of earning heads tagged in Pay Structure definition are shown below

Head Code |

Identification |

Period |

Work Days |

Formula |

Calculation Type |

Calculation Factor |

Basic |

Basic |

Monthly |

|

|

Prorata Basis |

Amount |

HRA |

HRA |

Monthly |

|

Basic |

Prorata Basis |

Percentage |

Conveyance |

Conveyance |

Monthly |

|

|

Prorata Basis |

Amount |

Leave Encashment |

Leave Encashment |

Monthly |

30 |

Basic |

Prorata Basis |

Amount |

Bonus |

Bonus |

Annual |

|

Basic |

Prorata Basis |

Amount |

Gratuity |

Gratuity |

Monthly |

26 |

Basic |

ProrataBasis |

Amount |

Sales Incentive |

Other |

Monthly |

|

|

Amount to be asked |

Amount |

Night Allowance |

Other |

Monthly |

|

|

Days to be asked |

Rate |

Medical Bill |

Reimburse-ment |

Monthly |

|

|

Prorata Basis |

Amount |

Identification: Identification of each head as defined in Earning master is displayed here against the selected head.

Effective Date: Enter the effective date from which the heads will be put into work. Any CTC prior to this date will not get this head for selection. Also editing of earning master cannot be possible in payslip generated months, and it needs to be changed effective from next payslip generated month.

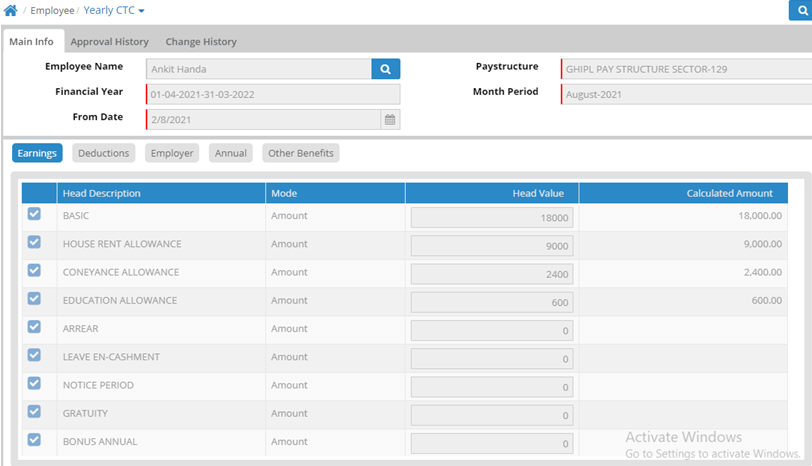

Period: Calculation earning / deduction head can be done

● Monthly

● Yearly

● Half Yearly

● Quarterly

The period defined here will be used to calculate the value of the amount payable in the Employee Yearly CTC screen. If the calculation period is monthly, and the value entered is 1000, then the maximum payable amount in the year will be 12,000/-. The total of monthly payments for all earning heads will be aggregated and shown in the yearly figure

Head |

Period |

Value |

Payable Amount |

Yearly CTC |

Annual |

Other Benefits |

Basic |

Monthly |

10000 |

120000 |

192000 |

|

|

HRA |

Monthly |

5000 |

60000 |

|

|

|

Conveyance |

Monthly |

1000 |

12000 |

|

|

|

Sales Incentive |

Quarterly |

3000 |

12000 |

|

|

22000 |

Performance Incentive |

Half Yearly |

5000 |

10000 |

|

|

|

Bonus |

Yearly |

10000 |

10000 |

|

10000 |

|

Work Days: For some heads, like Gratuity, month days are not used for calculation but 26 days are used for calculation or as defined by applicable regulations. Gratuity = (Basic + DA) x 15/26 x number of years.

For most of the earning and deduction heads default work days will be calculated as per month days i.e. on the actual number of days in a month. In case the number of days used for calculation is fixed, the preference has to be enabled in Preference Setup.

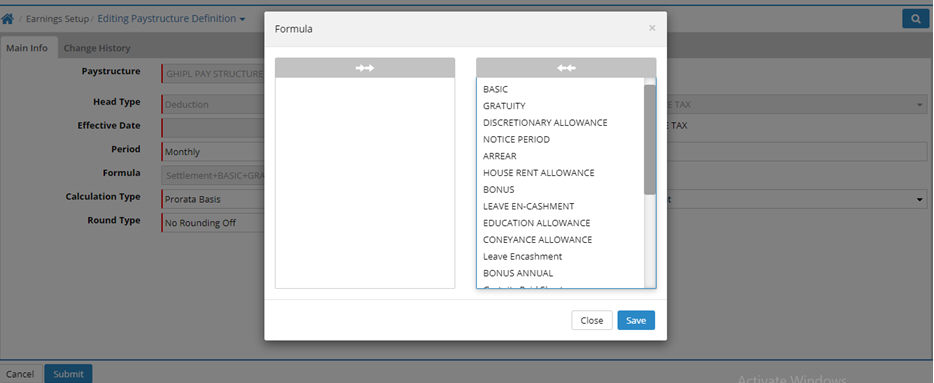

Formula: A formula has to be defined to calculate the value of the earning or deduction heads. In the pop-up window, earning/deduction heads are available for selection.

For Basic, as it is the primary earning, there is no formula and no head will be available for formula setting. For all other earnings/deductions, multiple heads which can be combined to derive the value on which calculation will be done.

Available heads which have to be used for deriving the calculated value are displayed in the left panel. Right panel shows heads which have been selected. Click on a head to move it from the existing panel (available head or selected heads) to the other panel. By clicking on the double arrow above, all heads will be moved.

Example

For earning house rent allowance (HRA), the formula can be Basic+DA, first select earning head 'Basic', then select earning head 'Dearness Allowance'.

Formula |

|

Head |

Formula |

HRA |

Basic |

Over Time |

Basic |

PF |

Basic |

Income Tax |

Basic+HRA+Conv |

Professional Tax |

Basic+HRA+Conv |

Calculation Type: Select the basis of earning. Options available here are:

Calculation Type |

|

Head |

Calculation Type |

Basic |

Prorata Basis |

Leave Encashment |

Fixed number of days |

Night Allowance |

Days to be asked |

Over Time |

Hours to be asked |

Incentive |

Amount to be asked |

Rent |

Other Fixed Amount |

OT (Security Staff) |

Hourly Rate |

Transport Allowance |

Present Days |

Hourly Rate - for any Calculation factor which is on rate basis, the calculation type should hourly rate. e.g Overtime

Amount - has to be selected for Calculation factors which are Prorata, Variable and Fixed. Example Basic, HRA, Conv, all variable input heads amount based.

Percentage - Some calculation like HRA is 50% of Basic. This is also used for auto calculation of earnings in CTC based pay structure and CTC based increment.

Prorata calculation - is based on the number of salary days as per attendance.

Fixed number of days - is as per number of days in the month.

Days/Hours/Amount - as specified in the variable input screen, it will be taken in salary calculation. Hourly rate as specified in CTC will be calculated on specified hours of work.

If calculation type is present days then calculation will be based on the number of days the employee was physically present in the office. Offday and Holidays will not be considered here.

Calculation Mode: When defining Yearly CTC and CTC based Pay Setup, calculation mode is used for determining the treatment of values entered in earning and deduction heads. Available options for treatment of value entered in CTC Setup are Amount, Rate, Percentage and Not Applicable.

Calculation Mode |

|||

Head |

Calculation Mode |

Value (defined in CTC) |

Treatment |

Basic |

Amount |

30,000.00 |

30,000.00 (no calculation) |

OverTime HO |

Rate |

1.5 |

x 125.00 (125 is calculated from OT setup) |

Over Time Site |

Rate |

1000 |

x 10 hours (10 hrs is picked from input variable) |

HRA |

Percentage |

50 |

50% of 30,000 (30000 is derived from formula) |

PF |

Not Applicable |

NA |

12% (auto calculated by system) |

Amount and Rate will be taken from CTC for salary calculation. In case of percentage, the calculation is based on formula, so formula is mandatory here. If Not applicable option is specified then the value will be derived from setup screen like Provident Fund setup.

Month days & Salary days = 30 |

||||||

In Paystructure Definition |

Yearly CTC |

Payslip |

||||

Head |

Calculation Type |

Calculation Mode |

Formula |

Value |

Calculated Amount |

Payslip Amount |

Basic |

Prorata Basis |

Amount |

|

10000 |

10000 |

10000 |

HRA |

Prorata Basis |

Percentage |

Basic |

50% |

5000 |

5000 |

Conv |

Prorata Basis |

Amount |

|

2000 |

2000 |

2000 |

Income Tax |

Prorata Basis |

Amount |

Basic+HRA+Conv |

0 |

0 |

500 |

Incentive |

Amount to be asked |

Amount |

|

3000 |

3000 |

3000 |

Over Time |

Hours to be asked |

Amount |

Basic |

8 |

333 |

333 |

Round Type: Select round type. This primarily concerns treatment of amounts of the head which have decimals in them i.e. contain denominators of a currency. This will apply to the derived or calculated value of a head.

The value of the relevant head will be changed to

● No Round Off - value will remain in decimals, if any. Eg Basic 8910.34

● Nearest 1 - value will be rounded off to the nearest whole figure. If decimal is half or more it will take next higher figure, if less it will take lower interger figure, 8910.34 = 8910.00 and 8910.64 = 8911.00

● Next 1 - value will be changed to next higher integer number for any decimal value, 8910.34 = 8911.00

Deductions

As earnings are defined for pay structure type, similarly deduction heads are to be defined from here. Most of the information is common to the earning heads screen.

Head Code |

Identification |

Period |

Formula |

Calculation Type |

Calculation Factor |

PF |

Provident Fund |

Monthly |

Basic |

Prorata Basis |

Amount |

ESIC |

ESI Contribution |

Monthly |

Basic+HRA+Conveyance+Child education Allowance+SiteAllowance+Special Allowance |

Prorata Basis |

Amount |

P.Tax |

Professional Tax |

Monthly |

Basic+HRA+Conveyance+Child education Allowance+SiteAllowance+Special Allowance |

Prorata Basis |

Amount |

I.Tax |

Income Tax |

Monthly |

Basic+HRA+Conveyance+Child education Allowance+SiteAllowance+SpecialAllowance+LeaveEncashment+LTA+Bonus + Sales Incentive+Night Allowance |

Amount to be asked |

Amount |

Advance |

Advance |

Monthly |

|

Prorata Basis |

Amount |

Misc Deduction |

Other |

Monthly |

|

Amount to be asked |

Amount |

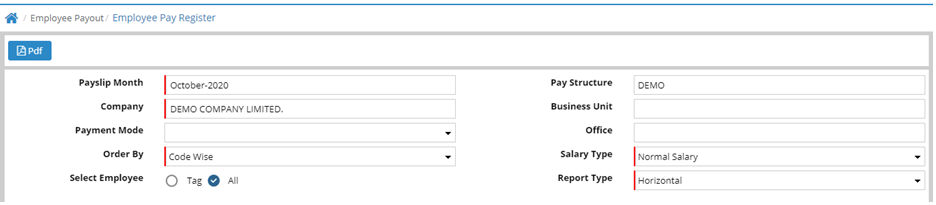

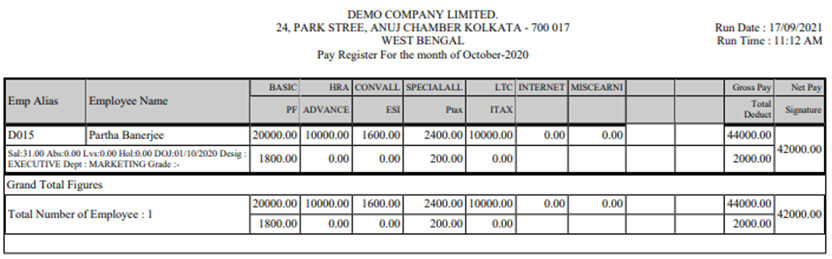

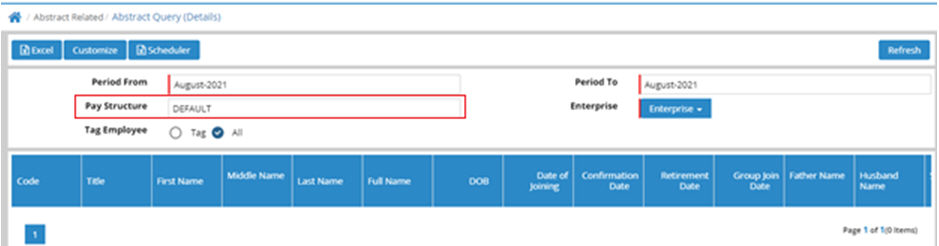

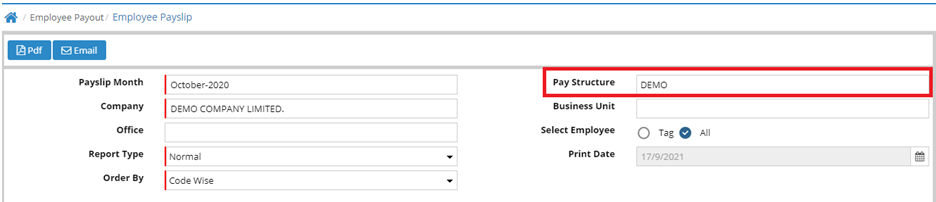

Report Usage

1. Employee Pay Register

2. Abstract Query

3. Employee Payslip

![]() Tutorial: Creating Pay Structure Definition

Tutorial: Creating Pay Structure Definition

© Gamut Infosystems Limited