![]() Tutorial: Creating Pay Structure Master

Tutorial: Creating Pay Structure Master

Pay Structure Master

The Pay Structure Master interface is used to create names for pay-structures. Pay Structure can be created at enterprise level or at the company level. Multiple pay-structures can be prepared as per the organisation’s requirement. Details of the pay structure are defined through Pay Structure Definition.

Single Paystructure for the enterprise:

Enterprise |

Company |

Paystructure |

ABC |

ABC Company |

ABC-HO |

ABC |

XYZ Company |

ABC-HO |

Individual Paystructure for each Company:

Enterprise |

Company |

Paystructure |

ABC |

ABC Company |

ABC-HO |

ABC |

XYZ Company |

XYZ-HO |

Multiple Paystructure for single Company:

Enterprise |

Company |

Paystructure |

ABC |

ABC Company |

ABC-HO |

ABC |

ABC Company |

ABC-SITE1 |

ABC |

ABC Company |

ABC-Batching Plant |

Use cases for different pay structures

1.If pay registers have to be maintained separately for employees on the basis of location/site/project or business unit then different pay structures are required.

2.Different pay structures are also required if account head posting needs to be different. Example, site or project expenses need to be booked separately. Another example, Administrative or management salary has to be separated from salary for the other employees.

3.Different pay structures have to be planned if the calculation basis of earning or deduction heads is different. Example, Overtime earning head can have different calculation factors like normal, production and different rates. Another example is that PF applicable on limit is different or additional PF is applicable for some employees.

4.Some earning or deduction heads are available for a specific pay structure. Example, Site Allowance is given to site employees only and therefore a new pay structure master needs to be created for Site employees.

The pay structures have to be designed keeping in mind the variations or requirements of any organisation. More details of factors to be kept in mind while planning pay structures are discussed at the end of this topic.

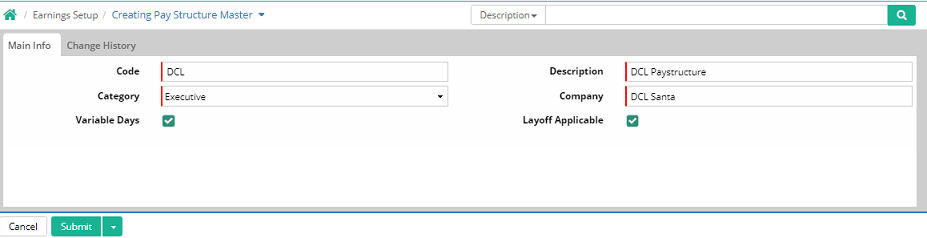

Code:

Enter short name of the pay-structure

Description: Enter the description of the pay-structure

Category: Choose

the employment category. Options include executive and non-executive.

Pay Structure Category |

Employee Category |

Executive |

Skilled |

Executive |

Semi-Skilled |

Non-Executive |

Un-Skilled |

Company: Select the name of the company for which the Pay structure needs to be tagged. Leave it blank in case a single pay structure is used for all companies, i.e. at the enterprise level.

Variable Days: Variable days refer to the number of days in a month which will be used to determine the days calculation for monthly attendance. If not checked, then the actual days of the month will be counted i.e. 28, 29, 30 or 31 depending on the month. If the days to be considered in month are variable, then check this box. Example for usage of variable days, if 30 days are to be considered in a month, irrespective of actual days in the month. The days to be considered as the variable value have to be specified in the monthly attendance interface.

Impact on salary if variable days are enabled or disabled

Gross 30000 |

||||

Type |

Paystructure |

Salary Days |

Month Days |

Net Pay |

Variable Days Basis |

ABC-HO |

28 |

30 |

28000 |

ABC-Site1 |

29 |

30 |

29000 |

|

XYZ-HO |

30 |

30 |

30000 |

|

Month or fixed Days Basis |

ABC-HO |

28 |

28 |

30000 |

ABC-Site1 |

29 |

31 |

28065 |

|

XYZ-HO |

30 |

30 |

30000 |

|

Company Wise Pay Register |

||||

XYZ |

||||

Head |

Calculation |

Posting |

Pay Register/Organisation Hierarchy |

Category |

Basic |

50% of CTC |

Employee Expenses |

XYZ |

Skilled |

HRA |

25% of CTC |

|||

Conveyance |

25% of CTC |

|||

PF |

12% |

|||

|

|

|

|

|

ABC |

||||

Head |

Calculation |

Posting |

Pay Register/Organisation Hierarchy |

Category |

Basic |

50% of CTC |

Employee Expenses |

ABC |

Skilled |

HRA |

25% of CTC |

|||

Conveyance |

25% of CTC |

|||

PF |

12% |

|||

Benefits are different for Management employees & other Employees |

||||

ABC-HO Mgmt |

||||

Head |

Calculation |

Posting |

Pay Register/Organisation Hierarchy |

Category |

Basic |

50% of CTC |

Employee Expenses - HO |

Management - HO |

Skilled |

HRA |

25% of CTC |

|||

Conveyance |

25% of CTC |

|||

Reimbursement |

Internet - 2000, Phone - 1000 |

|||

PF |

12% |

|||

|

||||

ABC-HO Normal |

||||

Head |

Calculation |

Posting |

Profile/Organisation Hierarchy |

Category |

Basic |

50% of CTC |

Employee Expenses - HO |

HO |

Skilled |

HRA |

25% of CTC |

|||

Conveyance |

25% of CTC |

|||

Overtime-Normal |

@1.5 Per Hour |

|||

PF |

12% |

|||

Change in Posting for Head Office & Site Office |

||||

ABC-HO |

||||

Head |

Calculation |

Posting |

Profile/Organisation Hierarchy |

Category |

Basic |

50% of CTC |

Employee Expenses - HO |

HO |

Skilled |

HRA |

25% of CTC |

|||

Conveyance |

25% of CTC |

|||

PF |

12% |

|||

|

||||

ABC-Site |

|

|

|

|

Head |

Calculation |

Posting |

Profile/Organisation Hierarchy |

Category |

Basic |

50% of CTC |

Employee Expenses - Site |

Site |

Skilled |

HRA |

25% of CTC |

|||

Conveyance |

25% of CTC |

|||

PF |

12% |

|||

Change in Categories of Employees |

||||

ABC- Site1 - SK |

|

|

|

|

Head |

Calculation |

Posting |

Profile/Organisation Hierarchy |

Category |

Basic |

40% of CTC |

Employee Expenses - Site1 |

Site1 |

Skilled |

HRA |

25% of CTC |

|||

Conveyance |

25% of CTC |

|||

PF |

12% |

|||

|

||||

ABC- Site1 - SS |

|

|

|

|

Head |

Calculation |

Posting |

Profile/Organisation Hierarchy |

Category |

Basic |

40% of CTC |

Employee Expenses - Site1 |

Site1 |

Semi-Skilled |

HRA |

25% of CTC |

|||

Conveyance |

25% of CTC |

|||

PF |

12% |

|||

|

||||

ABC- Site1 - US |

|

|

|

|

Head |

Calculation |

Posting |

Profile/Organisation Hierarchy |

Category |

Basic |

40% of CTC |

Employee Expenses - Site1 |

Site1 |

Un-Skilled |

HRA |

25% of CTC |

|||

Conveyance |

25% of CTC |

|||

PF |

12% |

|||

![]() Tutorial: Creating Pay Structure Master

Tutorial: Creating Pay Structure Master

© Gamut Infosystems Limited