![]() Tutorial: Creating Earning Master

Tutorial: Creating Earning Master

Earning Master

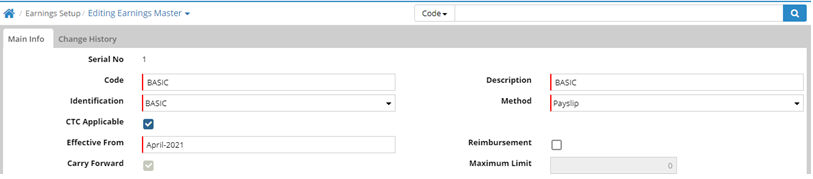

Earning Master interface is used to define earning heads and configure how the earning head calculations will be done. Pay Structure Definition is the controlling interface where applicable earning heads have to be tagged. If an earning head is not tagged in the Pay structure definition, it will not be available for use anywhere else in Farvision payroll.

Examples of some common earning heads include Basic, HRA, Conveyance Allowance, Overtime, Leave Encashment and Bonus.

Serial Number: A serial number is automatically generated for each earning head. Serial numbers determine the sequence in which the earning heads will be displayed in the Payslip and Final Settlement.

Code: Enter a

short name for

the earning head.

Description: Provide a description

for the

earning head.

Identification: Pre-defined identifications have been provided in Farvision. For some earning head there is a special treatment and it has to be tagged to the specific Identification so that calculation can be done as per requirement. More details of the processing of some earning heads like Reimbursements, Gratuity, Overtime, LTA are covered individually. Most of the other identifications have an impact on Income Tax computation.

Identification |

Earning Head |

Used for |

Basic |

Basic |

HRA, Gratuity, Leave Encashment, etc are dependent of Basic |

HRA |

HRA |

Used in computation of Income Tax, PF, etc |

Conveyance Allowance |

Conveyance Allowance |

Computation of Income Tax |

Education Allowance |

Education Allowance |

Computation of Income Tax |

Others |

Any other head not in this list, example Staff Welfare, Sales Incentive, Special Allowance |

No special treatment or has no Impact in any calculation |

Leave Encashment |

Leave Encashment |

Auto leave encashment calculation |

Bonus |

Bonus |

For Bonus generation from Bonus Menu |

Dearness Allowance |

Dearness Allowance |

Computation of Income Tax, PF, etc |

Ex-Gratia |

Ex-Gratia |

Ex-Gratia is used when not covered under the Bonus Act |

Notice Period |

Notice Period |

Notice Period Payment |

Education Reimbursement 1'st Child |

Education Reimb. 1'st Child |

Computation of Income Tax |

Education Reimbursement 2'nd Child |

Education Reimb. 2'nd Child |

Computation of Income Tax |

Hilly Allowance |

Hilly Allowance |

Where transportation is limited, Computation of Income Tax |

LTA |

LTA |

Computation of Income Tax |

Phone Bill |

Phone Bill |

Reimbursement calculation |

Round off Brought Forward |

Round off Brought Forward |

Payslip calculation |

Gratuity |

Gratuity |

Gratuity calculation |

Overtime |

Over Time - Normal, Over Time - Holiday |

Overtime calculation |

Reimbursement |

Petrol, Phone, Medical, Meal Vouchers |

Reimbursement calculation |

Reimbursements

Some examples of earning heads which are reimbursed by the employer as listed below.Earning Heads |

Identification |

Method |

Is Reimbursement |

Is CTC head |

Petrol |

Reimbursement |

Payslip |

Yes |

Yes |

Driver |

Reimbursement |

Payslip |

Yes |

Yes |

Medical Bill |

Reimbursement |

Outside Payslip |

Yes |

No |

Conveyance Expense |

Reimbursement |

Outside Payslip |

Yes |

No |

If Reimbursement is a part of CTC, then Reimbursements are processed through the Reimbursement form. Reimbursement can also be paid as a variable amount which may or may not be the part of CTC.

Method: Payout of earning heads can be done through Payslip or Outside payslip. Payments which are fixed in nature and/or part of CTC are usually paid through payslip. Payments which are variable in nature, for example reimbursements on actual basis or incentives are normally paid outside payslip, i.e. through voucher payment.

Payment through Payslip

Earning heads which are tagged with Payslip method will be shown in the payslip. Earning heads which have variable values and may or may not be a part of CTC can be paid through payslip mode. If the variable amount has to be shown as part of salary, then use this mode else use the outside payslip mode.

| Earning Heads | Identification | Method |

| Basic | Basic | Payslip |

| HRA | HRA | Payslip |

| Conveyance | Conveyance | Payslip |

| Child Education Allowance | Education Allowance | Payslip |

| Site Allowance | Other | Payslip |

| Petrol | Reimbursement | Payslip |

| Leave Encashment | Leave Encashment | Payslip |

| LTA | Leave Travel Allowance | Payslip |

| Bonus | Bonus | Payslip |

Outside Payslip

If the payment method is Outside Payslip, payment will be made through voucher. If payment requisition option has been activated, the payment requisition for each earning head will be automatically sent for payment through voucher in the Finance module. The payout amount for payment outside payslip is entered through the Outside Payslip variable.

| Earning Heads | Identification | Method |

| Gratuity | Gratuity | Outside Payslip |

| Sales Incentive | Other | Outside Payslip |

| Conveyance Expense | Reimbursement | Outside Payslip |

CTC Applicable: If this option is checked then the earning head will appear in the Yearly CTC entry screen where CTC of employees is defined. Normally variable earnings are not part of CTC, the rest depends on the company policy.

Effective From: This option denotes the specified date from which the Earning Head is applicable. Any CTC prior to this date will not get this head for selection. Also editing of earning master cannot be possible in payslip generated months, and it needs to be changed effective from next payslip generated month.

Carry Forward: This is only available in case the earning head is a reimbursement. If checked, the eligible but unpaid monthly reimbursement amount can be carried forward for payment in future months.

Maximum Limit: This is only available in case the earning head is a reimbursement. Maximum amount entitled or eligible for the reimbursement earning head can be defined here. Employee wise maximum limit for that can be reimbursed is defined through the CTC of the employee.

![]() Tutorial: Creating Earning Master

Tutorial: Creating Earning Master

© Gamut Infosystems Limited