![]() Tutorial:

Creating Employee Yearly CTC

Tutorial:

Creating Employee Yearly CTC

Yearly CTC for employees has to be configured from this interface. Earnings, Deductions, Employer, Annual and Other Benefits defined in the selected Pay Structure will be automatically populated and figures as applicable have to be defined for each employee.

Employee Name: Select Employee name whose CTC needs to be created/Existing Employee CTC needs to be changed. Here only those employee will be available whose Employee Master and Organization Master are present and the employee is in working status (Defined through Transaction > Employee > Employee Master).

Paystructure: Select paystructure from the available list which is relevant to the selected employee (Defined through Setup > Earnings Setup > Pay Structure Master).

Financial Year: Select the financial year for which yearly CTC for an employee has to be defined.

Month Period: Select the month from which the CTC will be effective. This cannot be earlier than the joining date of an employee. If salary has been generated for a month, yearly CTC cannot be entered for that period. For all or selected employees, if salary generation is deleted, the yearly CTC can be changed and then salary generated again.

From Date: For an existing employee, specify 1st of month. For a new employee whose yearly CTC is being defined for the first time, it will be the joining date from the employee master.

Here head values of all available heads for the selected employee needs to be specified. The heads where CTC value is applicable need to be checked.

Earnings

Head Description: For earning heads whose payment frequency in Pay Structure definition is monthly will be automatically displayed here. Select all applicable earning heads. Only if the earning head is checked here, will it be available for entering amount against that head. This is especially important to remember for those heads whose earning amount is not entered through this interface. Examples, Variable inputs, Overtime, Outside payslip, Leave Encashment.

Calculation type: Calculation type for the earning heads will be picked up from the Pay Structure definition and displayed here.

Head Value: Enter the amount which has to be paid to the employee.

Calculated amount: Amount is automatically calculated. For heads whose calculation type is percentage, the figure will calculated and displayed. For calculation type – rate, no calculated amount will be displayed here.

Deductions

Head Description: All deduction heads of the Pay Structure definition will be automatically displayed here. Select all applicable deductions heads.

Calculation type: Calculation type for the earning heads will be picked up from the Pay Structure definition and displayed here.

Head Value: For statutory deduction heads like PF, ESI, PTax, the amount to be deducted from the employee will be automatically calculated. For Advance, Loan, Interest on Loan, do not enter any value, it will be automatically calculated. For any other deduction head, the amount to be deducted can entered.

Calculated amount: Amount is automatically calculated. For heads whose calculation type is percentage, the figure will calculated and displayed.

Employer

Deductions heads applicable to the employee and for which there Employer contribution heads will be automatically here. No entry can be done here, this is an information only screen.

Annual

Head Description: For earning heads whose payout frequency is not monthly, i.e. Half yearly or Yearly, will be displayed here. Example, Gratuity, Bonus, Leave Encashment (yearly), Advance, Loan, Bonus, Overtime, Income Tax and variable inputs.

Calculation type: Calculation type for the earning heads will be picked up from the Pay Structure definition and displayed here.

Head Value: Enter applicable amount which has to be paid. For some earnings or deduction heads like Leave Encashment, Advance, Loan, Bonus, Overtime, Income Tax and variable inputs, values are entered/calculated from their respective screens. Do not enter any value here. Only the applicable heads have to be checked as applicable for the employee.

Calculated amount: Amount is automatically calculated. For heads whose calculation type is percentage, the figure will calculated and displayed.

Perks defined through Perks Master are displayed here. Select which ever perk is applicable to the employee and define the amount. Calculation of payable of the amount will be done as per definition in the Perks Master.

Attachment

Here user can upload documents, also able to view and download documents as per requirement.

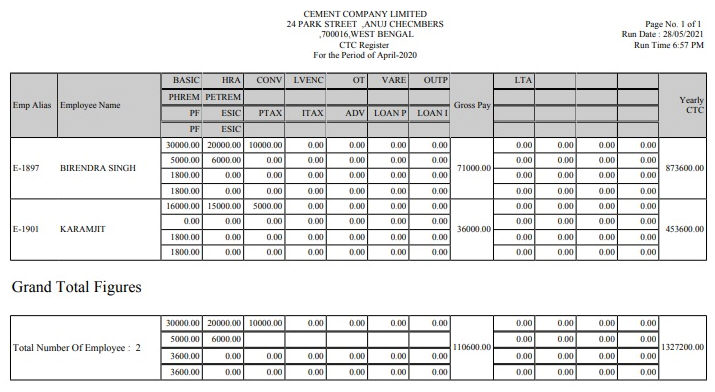

CTC Register Report

![]() Tutorial: Creating Employee Yearly CTC

Tutorial: Creating Employee Yearly CTC

© Gamut Infosystems Limited