![]() Tutorial: Creating Employee Master

Tutorial: Creating Employee Master

Employee Master

All the employee related information are to be recorded in the employee master interface, including ‘Personal Information’, ‘Joining Info’, ‘Other Details’, ‘Extra Information’, ‘PF Details’, ‘ESI Details’ and ‘Passport Details’.

Main Info

Personal Information:

All personal information about the employee including company, code, user id, name, guardian’s name, marital status, gender, date of birth etc. will be recorded in this section.

Company: Select the company where the employee belongs to. The available list will show all the companies within the Enterprise. This is a mandatory field

Code: Enter code of the employee. This code can be manually specified or auto generated. Employee code should be unique within the Enterprise. This is a mandatory field

Title: Select the title of the employee. The titles are available for selection from predefined list. This is a mandatory field

Photo: Browse and select the photograph of employee. The employee photo should be a jpg file. This is not a mandatory field

First Name: Enter first name of employee. This is a mandatory field

Middle Name: Enter middle name of employee. This is not a mandatory field

Last Name: Enter last name of employee. This is a mandatory field

User ID: If the employee is already having a login Id as a Farvision user then specify that login ID. This is not a mandatory field

Guardian Name: Enter guardian name of the employee. This is a mandatory field

Spouse Name: Enter spouse name of the employee. This is not a mandatory field

Gender: Select gender of the employee. The gender is available for selection from predefined list. This is a mandatory field

Marital Status: Select marital status of the employee. The options are available for selection from predefined list. This is a mandatory field

Religion: Select religion of the employee. The religions are available for selection from Religion master. This is a mandatory field

Nationality: Select nationality of the employee. The nationalities are available for selection from Nationality Master. This is a mandatory field

Date of Birth: Enter date of birth of the employee. This is a mandatory field

Calendar Type: Select salary generation calendar type of the employee. The calendar type is available for selection from predefined list. This is a mandatory field

Joining Info:

All joining related information including date of joining, date of group join, retirement date and confirmation date will be specified in this section.

Date of Join: Enter date of join of the employee in the above specified company. The difference between 'Date of Birth' and 'Date of Join' of an employee should be as per Minimum Age specified in Configuration > Preference Setup

If the age is set as 18 years then on the date of joining of the employee his/her age should be 18 or more years. If the period between date of birth and date of joining is less than 18 years then the Employee master record will not save. This is a mandatory field.

Example

Employee Mr. X joined an Enterprise known as Pioneer Corporation and was allocated to one of its companies ABC Co. P. Ltd. His date of joining was 15th August 2008. At this time his Joining Date and Group Join date was updated as 15/08/2008.

He worked in this company for three years. Later on he was shifted to PQR Ltd. on 16/08/2011 for the same enterprise. At that time his Joining Date was specified as 16/08/2011 but his Group Join date remains same as 15/08/2008.

Group Join: The Date of Join will automatically copied to group join. This date can be modified if required. Group Join date is the join date in Enterprise. In case of reallocation of employee from one company to another within the enterprise then also the Group join date remains same. This is a mandatory field.

Retirement Date: The date of retirement will be auto calculated by the system based on specified date of birth and the Retirement Age mentioned in Configuration > Preference Setup

Example

If the date of birth of an employee is 22/01/1998 and the Retirement Age mentioned in preference setup is 60 years then the date of retirement will be 21/01/2048.

Confirm Date: The date of confirmation will be auto calculated by the system based on specified date of joining and the Confirmation Period mentioned in Configuration > Preference Setup

Example

If the date of joining of an employee is 15/08/2008 and the Confirmation Period mentioned in preference setup is 6 months then the date of confirmation will be 15/02/2009.

Address Information:

Address details of the employee will be recorded in this section.

Address1: Enter first line of permanent address

Address2: Enter second line of permanent address

Address3: Enter third line of permanent address

Country: Select the name of country of Permanent address

State: Select the name of state of Permanent address

City: Select the name of city of Permanent address

Postal Code: Enter Postal Code of permanent address

Is same as permanent: If this button is clicked then the details of permanent address will be copied to current address.

Contact Information:

Contact information about the employee includes phone number, mobile number and email address.

Phone No: Enter official phone number of the employee. Click on the + button to specify personal phone number of the employee

Mobile: Enter official mobile number of the employee. Click on the + button to specify personal mobile number of the employee

Email: Enter official email address of the employee. Click on the + button to specify personal email address of the employee

Other Details:

Other details of employee includes previous code, blood group, working experience, anniversary date etc.

Previous Code: Previous Employee code if any can be specified here. Previous code means Employee code in previous company of the Enterprise

Blood Group: Blood group of the employee can be selected here. The default values of blood group are available for selection

Working Experience: Working experience of the employee can be entered in years

Anniversary Date: Anniversary Date of the employee

Working Hour: Default working hour of the employee can be specified here

Shift: Shift code of the employee is to be selected. Daily In Out time of the employee is determined from shift master as per specified shift code

Remarks: Any remarks related to employee can be specified here

Name as Proof: Exact name is to be entered as specified in Photo Identity or document

Pan No: Employee Pan number can be entered here

Ignore for Future Use: Click to deactivate the employee for future processing

Biometric Editable: This option is to be selected to enable manual attendance in FV Pay App

Employee Medical History: medical history of employee can be entered here

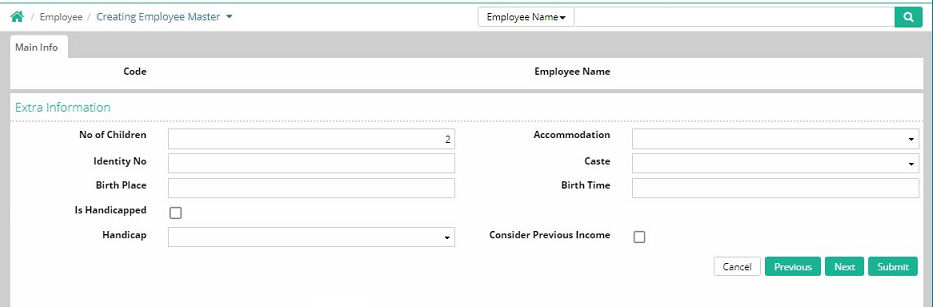

Extra Information:

Extra information about the employee includes number of children, identity number, birth place, accommodation, caste, birth time, handicap information etc.

No of children: Enter number of children of the employee. This is referred internally for calculation of IT deduction on Child Education.

Accommodation: Select the type of residence of the employee. Options of accommodation is displayed from accommodation master

Identity No: Enter employee number as specified in Identity Card

Caste: Cast of the employee can be selected from the options available from General/BC/OBC/Sc/ST/Others

Birth Place: Enter place of birth of the employee

Birth Time: Enter time of birth of the employee

Is Handicapped: It is to be selected if the employee is handicapped

Handicap: Select nature of Handicap if 'Is Handicapped' option is checked. Options of Handicap is displayed from Handicap master

Consider Previous Income: If this option is checked and income details of previous company for the same financial year is specified in savings declaration screen then this income will be considered in Yearly Tax computation

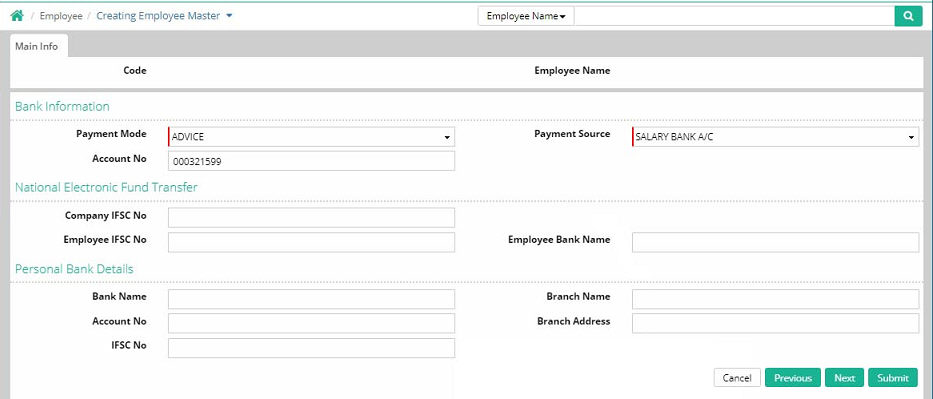

Bank Information:

Bank information of the employee includes payment mode, payment source and account number. NEFT and personal bank details can also be updated.

Bank Information

Payment Mode: Select mode of payment of salary

Payment Source: Select the bank name of the company from where salary is to be disbursed

Account No: Enter salary account number of the employee

National Electronic Fund Transfer

Company IFSC No: Enter IFSC Number of bank branch of the company

Employee IFSC No: Enter IFSC Number of bank branch of the employee

Employee Bank Name: Enter bank name of the employee

Personal Bank Details

Bank Name: Enter personal bank name of the employee

Branch Name: Enter bank branch name of the employee

Account No: Enter account number of the employee

Branch Address: Enter bank branch address of the employee

IFSC No: Enter IFSC Number of the bank branch of the employee

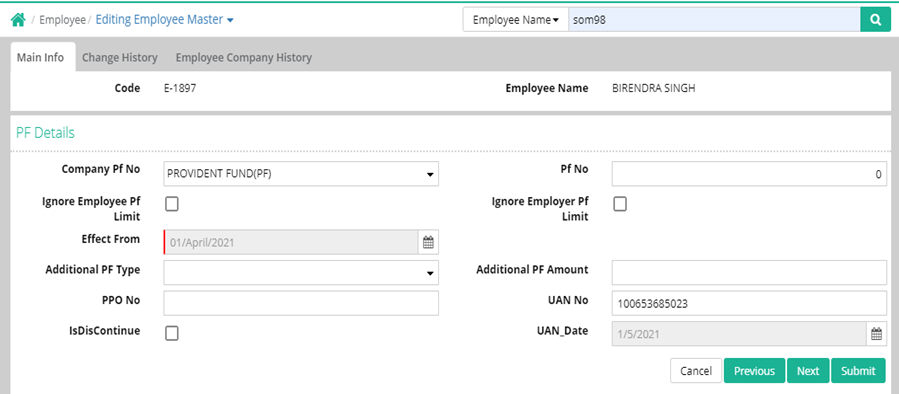

PF Details

Employee provident fund details are to be recorded here.

Company PF No: Select company provident fund registration number under which the employee is registered

PF No: Enter employee provident fund number as assigned by the company

Ignore Employee PF Limit: This box is to be checked if Employee Statutory PF limit for the employee is not applicable

Ignore Employer PF Limit: This box is to be checked if Employer Statutory PF limit for the employee is not applicable

Effect From: This is the effective date of the provident fund account

Additional PF Type: If Voluntary PF is applicable for the employee then type of payment needs to be specified from available options from Percentage/Amount

Additional PF Amount: If Voluntary PF is payable in amount then the payment amount needs to be specified. If Voluntary PF is payable in Percentage then the rate of payment needs to be specified

PPO No: Enter Pension Payment Order number of the employee

UAN No: Universal Account number of the employee is a unique number provided to all employee under PF. This number remains constant even if the employee changes his/her company

UAN Date: FPF calculation will be done considering this date i.e. an employee’s FPF calculation will be 0 or there will be an amount depending on the UAN date. For example, if an employee joins any company then FPF amount gets calculated as per Govt. rules considering group joining date but now instead of group joining date user can calculate the same from the UAN date.

ESI Details

Employee state insurance related information are to be recorded here

Company ESI No: Enter company ESI registration Number under which the employee is registered

ESI No: Enter employee ESI number as assigned by the company

Effect From: This is the effective date of the ESI account

Effect To: This is the effective date upto which the ESI account is valid

Doctor Name: Enter name of the ESI Doctor

Doctor Area: Enter area covered by ESI Doctor

EPehchan Card: It is the Permanent Identity Card for availing medical benefits till the eligibility for medical benefit exists.

Is Discontinue: This option is selected if at any point of time the ESI number is to be discontinued

Note: User can remove company ESI No from Employee Master

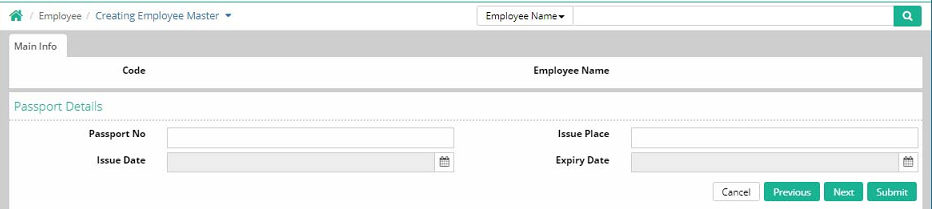

Passport Details

Employee passport details are to be recorded here

Passport No: Enter the passport number of the employee

Issue Place: Enter the place of Issuance of passport

Issue Date: Enter date of issue of passport

Expiry Date: Enter expiry date of Passport

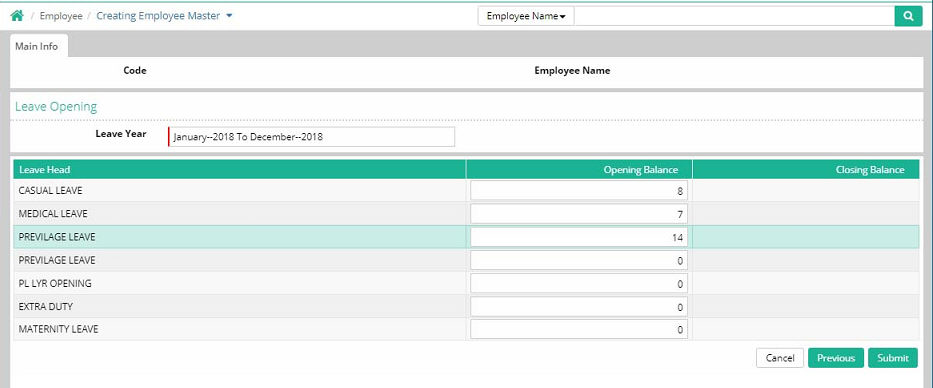

Leave Opening

Opening leave balance of the employee for the leave year are to be recorded here

Leave Year: Select Leave Year for which opening balance needs to be specified

All Leave Heads are automatically displayed and head wise opening balance as applicable at the time of joining of employee needs to be specified.

Employee Documents

Employee documents uploaded through Employee Portal > My Portal > Employee Profile are visible in Employee Master.

![]() Tutorial: Creating Employee Master

Tutorial: Creating Employee Master

© Gamut Infosystems Limited