![]() Tutorial: Creating Perks

Master

Tutorial: Creating Perks

Master

Perks Master

Perks are non-monetary compensation provided to employees in addition to their normal salary. Perks are defined through this setup. Perks can be a part of CTC which are given to employees as part of remuneration or cost is paid by the employer directly to the vendor against the perks. For example, Group Mediclaim is paid by the employer but is part of the employees CTC.

Code |

Description |

Payment Frequency |

Payment Mode |

Calculation Type |

Acc |

Accommodation |

Monthly |

Payslip |

Fixed |

Int |

Internet |

Monthly |

Payslip |

Variable |

Car |

Car |

Yearly |

Outside Payslip |

Variable |

Drv |

Driver |

Monthly |

Outside Payslip |

Fixed |

CCA |

Child Care Assistance |

Monthly |

Payslip |

Prorata Basis |

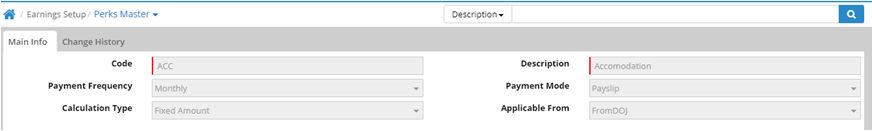

Main Info

Code: Enter a short name for the perk or benefit.

Description: Enter a description for the perk or benefit.

Payment Frequency: Select the frequency of the payment of perks or benefits to the employees from the drop down list. The frequency types include monthly, quarterly, half yearly and yearly.

Payment Mode: Select the payment mode - payslip, voucher and outside payslip. Perks which are tagged with Payslip will be shown in payslip. Perks which are monthly or paid frequently are normally paid through Outside payslip. Perks which are paid yearly or infrequently can be paid through Voucher mode also. Perks paid through Outside payslip or Voucher will go through the payment requisition, approval and voucher process.

Calculation Type: Select the calculation type from the drop down list. The calculation type includes prorata basis, variable and fixed amount. Prorata calculation is based on the number of salary days as per attendance. Fixed amount is irrespective of salary days in the month. Variable is a changing amount every month or selected months and is specified in the variable input screen.

Applicable From: Select the option from when the perks will be applicable. The perks will be applicable from DOJ (Date of joining). Target based functionality is in the product road map.

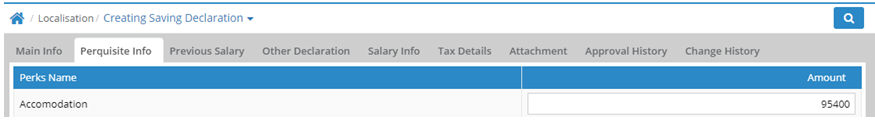

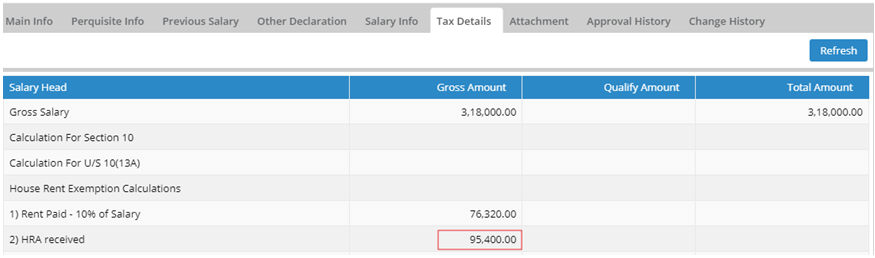

Depending on the accommodation, computation of income tax is determined through the Saving Declarations screen. If accommodation is given as a perk i.e. some amount is paid to the employees for it, then it is taxable and employees can take the benefit in Income tax under HRA.

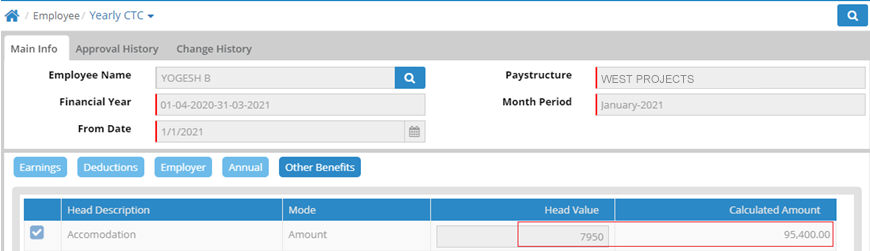

Perks are defined in Yearly CTC.

Accommodation shown in Saving declarations.

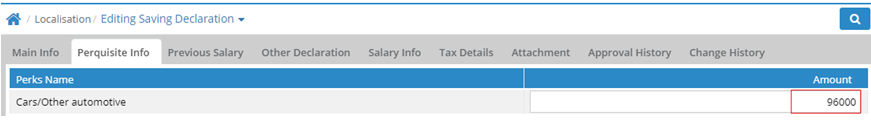

Other perks like Car/automotive is a taxable perk

![]() Tutorial: Creating Perks

Master

Tutorial: Creating Perks

Master

© Gamut Infosystems Limited