Credit Note is a brief written document (Note) produced to reduce/adjust the amount of payable. It shows the details of refund due to a customer. Under normal conditions, Credit Note presents the equivalent details of an invoice.

When users raise invoices to the customers then they debit their account. On certain occasions, they credit their account by issuing a Credit Note.

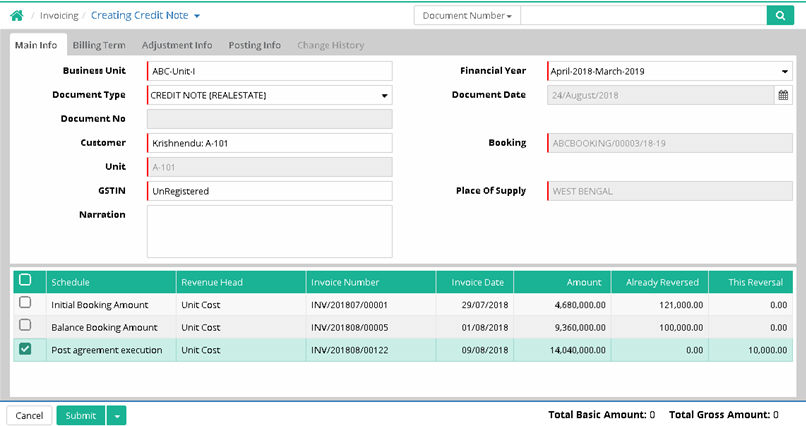

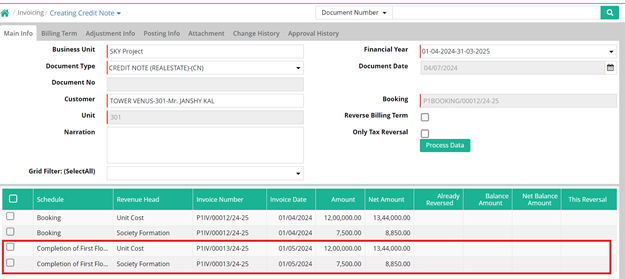

Main Info

Business Unit: Select business unit

Financial Year: It gets populated, however user can select another as per requirement

Document Type: It gets populated, however user can select another as per requirement

Document Date: It shows as on date by default. User can set another date.

Document No: It is generated after the entry saved

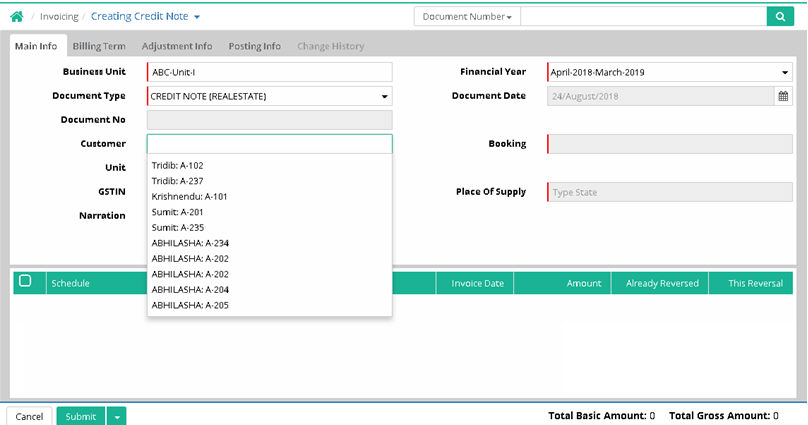

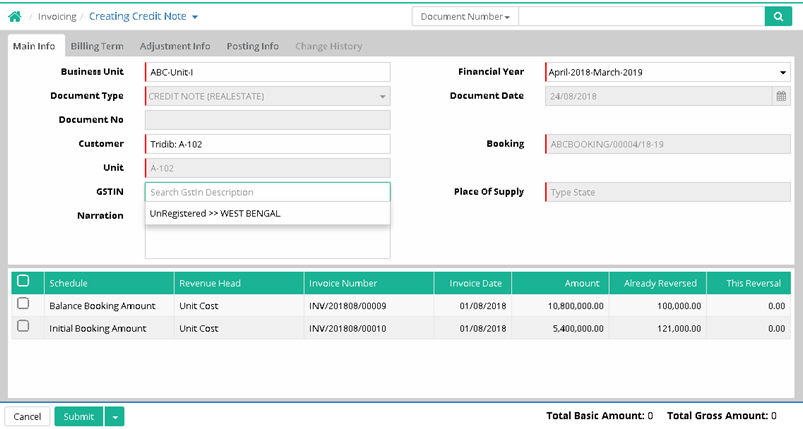

Customer: Select customer (Data comes from Transaction > Booking > Customer Details)

Booking: Booking number gets populated (Data comes from Transaction > Booking > Booking)

Unit: Unit code gets populated (Data comes from Setup > Unit > Unit)

GSTIN: Select Goods and Services Tax Identification Number for registered supplier, for unregistered supplier select Unregistered >> State Name

Place of Supply: The state name gets populated

Narration: Enter narration if any

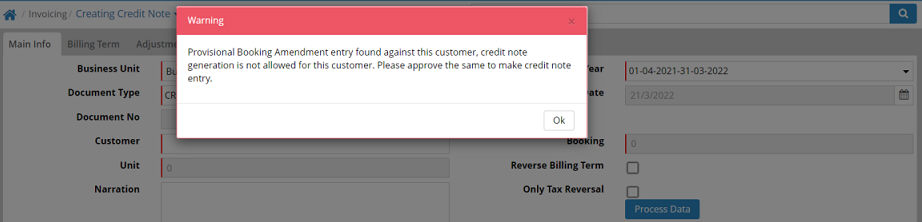

Note:

System will not allow to make any credit note entry against the booking if that booking is having any provisional Booking Amendment entry and showing a validation message as shown below.

![]() Tutorial:

Creating Credit Note

Tutorial:

Creating Credit Note

Demand reversal refers to the situation where a previously made demand is reversed or cancelled. This can happen for various reasons such as errors in invoicing, disputes with customers or changes in agreements. This is done via Credit Note and a new invoice may be generated for the correct amount or with the necessary changes. Demand reversal is a common practice in business transactions to rectify mistakes and ensure accurate financial records.

This can occur in two primary scenarios:

Scenario 1: If a demand (invoice) is mistakenly raised against a customer, a demand reversal entry is made to cancel that demand. This allows for the same demand to be raised against the same schedule/milestone in the future when it is appropriate.

Scenario 2: Another example of demand reversal occurs when a customer requests an extension of the payment date. By reversing the demand, the payment date can be extended, addressing the customer’s request.

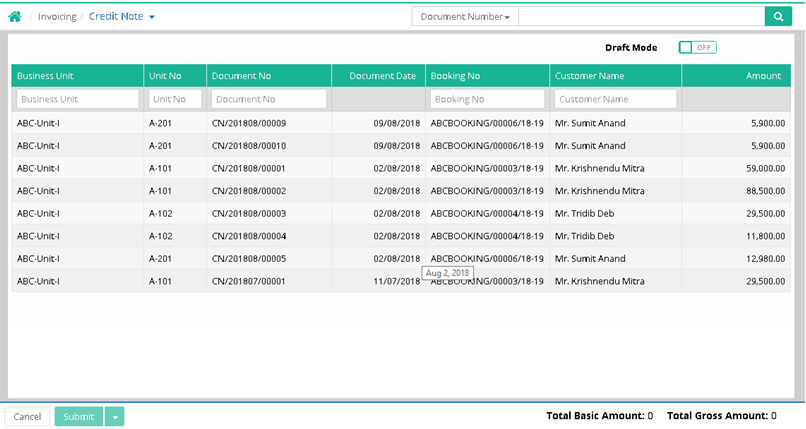

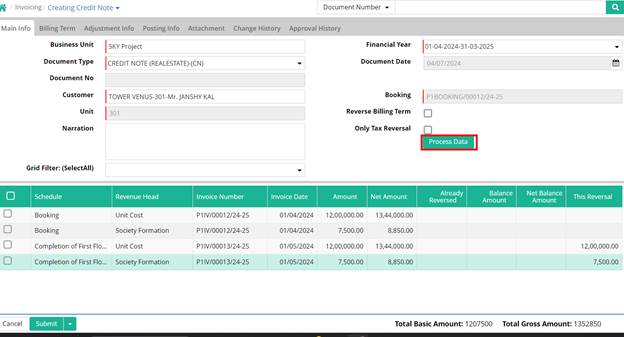

1. 1.Navigate to Sales and Customer Care> Invoicing> Credit Note. The following screen can be seen. Choose the appropriate Business Unit and enter the document date as per the demand reversal / credit note date. Select the relevant Customer from the list. Once the Customer is selected, the following grid will display all schedule-wise revenue heads.

2. 2.Select the specific Schedule/Revenue head as needed.

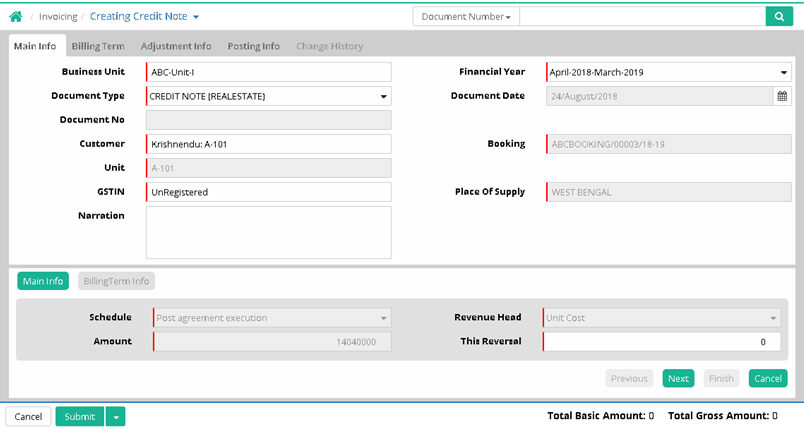

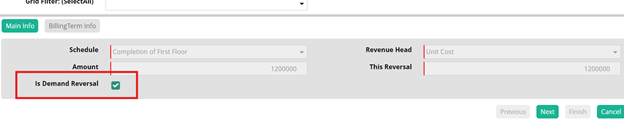

3. 3. The following window will open. Mark the ‘Demand Reversal’ option and proceed by clicking on the Next button.

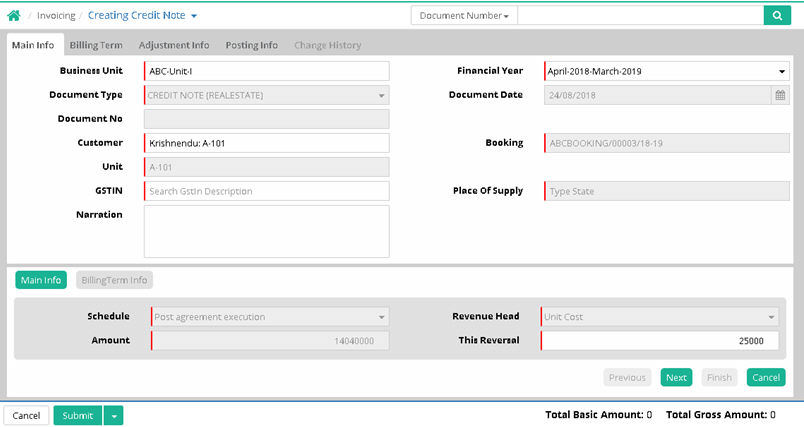

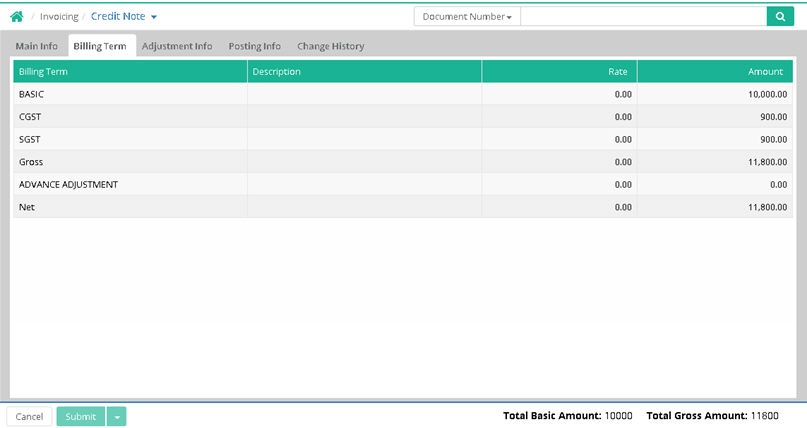

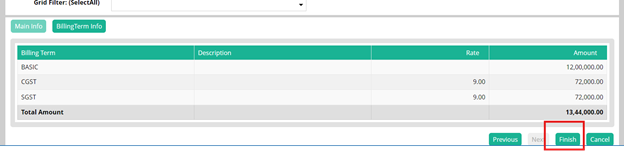

4. 4.The billing term will be automatically calculated at this stage. Click on Finish. The following screen would appear.

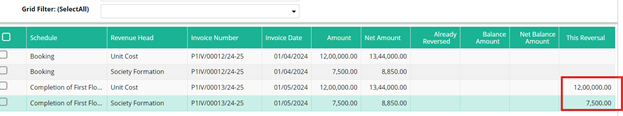

5. 5. Click on Process Data after the changes have been made so that the Ledger posting is complete. Now click on Submit to proceed further.

© Gamut Infosystems Limited