![]() Tutorial: Creating Deduction Master

Tutorial: Creating Deduction Master

Deduction Master

Deduction Master interface is used to define deduction heads and configure how the deduction head calculations will be done. Pay Structure Definition is the controlling interface where applicable deduction heads have to be tagged. If an deduction head is not tagged in the Pay structure definition, it will not be available for use anywhere else in Farvision payroll.

Examples of some common deduction heads are mentioned below:-

Deduction Heads |

PF |

ESIC |

P.Tax |

I.Tax |

Advance |

VPF |

Other Deduction |

Deduction heads are used for the purpose of payroll processing.

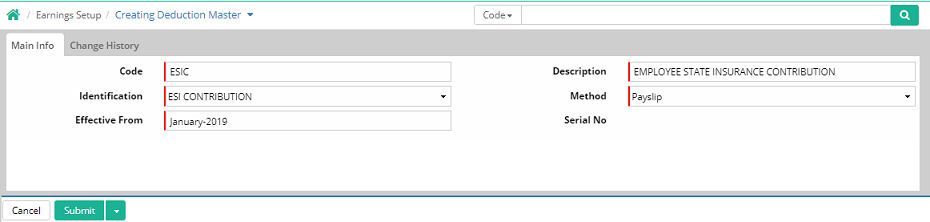

Code:

Enter short name of the new Deduction

head

Description:

Enter the description of the deduction head

Identification: Pre-defined identifications have been provided in Farvision. For some deduction head there is a special treatment and it has to be tagged to the specific Identification so that calculation can be done as per requirement. More details of the processing of some deduction heads like Provident Fund, ESIC, Income Tax, Professional Tax which have an impact on deduction as per compliance and also in Tax Computation.

Identification |

Deduction head |

Used for |

Provident Fund |

PF |

Statutory Deductions as per Act. (Based on formula & Statuary Limit), Basic |

ESI Contribution |

ESIC |

Statutory Deductions as per Act. (Based on formula & Statuary Limit), Gross Components |

Professional Tax |

P Tax |

Statutory Deductions as per Act. (Gross Components) |

Income Tax |

I Tax |

Statutory Deductions as per Act. (Based on formula for taxable components), Gross Taxable components |

Advance |

Advance |

Installment/Amount Based Advance given to employees against Salary |

Additional P.F |

VPF |

Voluntary Provident Fund/Additional PF deduction |

Notice Period |

Notice Period Deduction |

Notice Period Deduction |

Loan |

Loan Principal |

Principal head amount calculation |

Interest on Loan |

Loan Interest |

Interest head calculation |

Life Insurance Premium (LIC) |

Life Insurance Premium (LIC) |

LIC entry screen as a deduction head |

Advance Adjusted against Bonus |

Advance Adjusted against Bonus |

Giving advance against the Bonus |

Phone Bill Deduction |

Phone Bill Deduction |

Phone bill exceeding limit |

Other |

Other deduction |

Any Deduction head not covered in this list |

Sri Lanka Tax |

Sri Lanka Tax |

Tax used in Sri Lanka |

R. Carry Forward |

R. Carry Forward |

Rounding off carry forward (for deduction) |

Round Off |

Round Off |

Differential round off |

Facility |

Facility |

Amount which is part of employee CTC, but not paid directly to employees against the facility given |

Method: Deduction heads can be done through Payslip or Outside payslip. Deductions which are fixed in nature and/or part of CTC are usually done through payslip. Deductions which are variable in nature, for example reimbursements on actual basis or miscellaneous deductions are normally done outside payslip, i.e. through voucher method.

1. Payslip

Deduction heads which are tagged with Payslip method will be shown in the payslip. Deduction heads which have variable values and may or may not be a part of CTC can be deducted through payslip mode. If the variable amount has to be shown as a deducted part of salary, then use this mode else use the outside payslip mode.

| Deduction Heads | Identification | Method |

PF |

Provident Fund |

Payslip |

ESIC |

ESI Contribution |

Payslip |

P.Tax |

Professional Tax |

Payslip |

Income Tax |

Income Tax |

Payslip |

Advance |

Advance |

Payslip |

Loan Principal |

Loan |

Payslip |

Loan Interest |

Interest on Loan |

Payslip |

Additional PF |

Additional P.F. |

Payslip |

Life Insurance Premium (LIC) |

Life Insurance Premium (LIC) |

Payslip |

LWF |

Other |

Payslip |

MISC Deduction |

Other |

Payslip |

2. Outside Payslip

If the method is Outside Payslip, deduction will be made through voucher. If payment requisition option has been activated, the payment requisition for each deduction head will be automatically sent for receipt through voucher in the Finance module. The deducted amount outside payslip is entered through the Outside Payslip variable.

| Deduction Heads | Identification | Method |

| Electricity Bill | Other | Outside Payslip |

| Food Bill | Other | Outside Payslip |

| Notice Period Deduction | Notice Period | Outside Payslip |

Effective From: This option denotes the specified date from which the deduction Head is applicable. Any CTC prior to this date will not get this head for selection. Also editing of deduction master cannot be possible in payslip generated months, and it needs to be changed effective from next payslip generated month.

Serial Number: A serial number is automatically generated for each deduction head. Serial numbers determine the sequence in which the deduction heads will be displayed in the Payslip and Final Settlement.

![]() Tutorial: Creating Deduction

Master

Tutorial: Creating Deduction

Master

© Gamut Infosystems Limited