Bank dishonors a cheque if it finds the cheque being counterfeited or forged, materially altered, reported as lost or stolen, subject of a court order restraining payment, or some other valid reasons. A bounced or dishonored cheque can be reversed, if it is lost or erroneously issued.

This ‘Receipt Reversal’ interface has been designed to record a note about the particular reversed cheque along with its relevant details like cheque number, cheque date, and cheque amount.

Main Info

Business Unit: Select business unit

Financial Year: It gets populated, however user can select another as per requirement

Document Type: It gets populated, however user can select another as per requirement

Document Date: It shows as on date by default. User can set another date.

Document No: It is generated after the entry saved

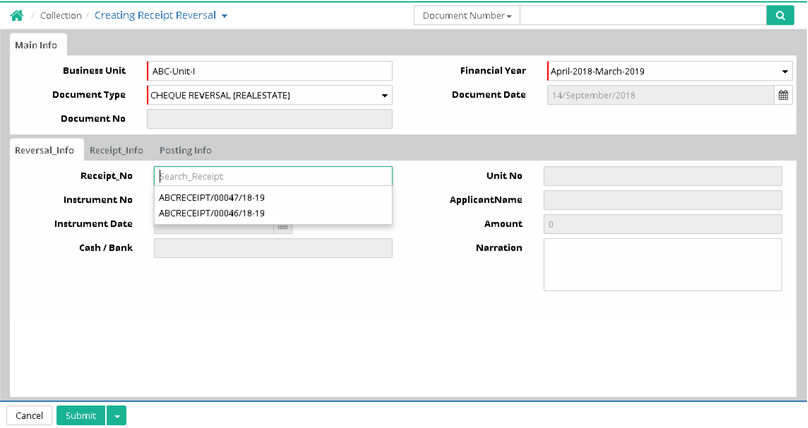

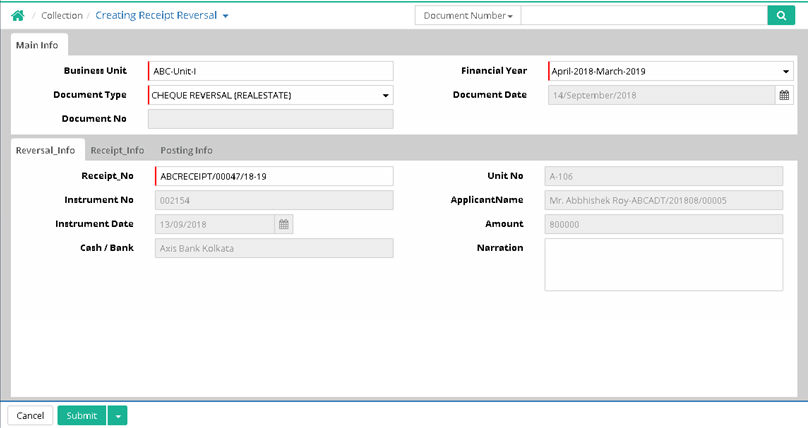

Reversal Info

Receipt No: Select receipt number, all other fields such as Unit No, Instrument No, Applicant Name, Instrument Date, Amount, Cash/Bank gets populated (Data comes from Transaction > Collection > Receipt).

Narration: Enter narration on receipt reversal

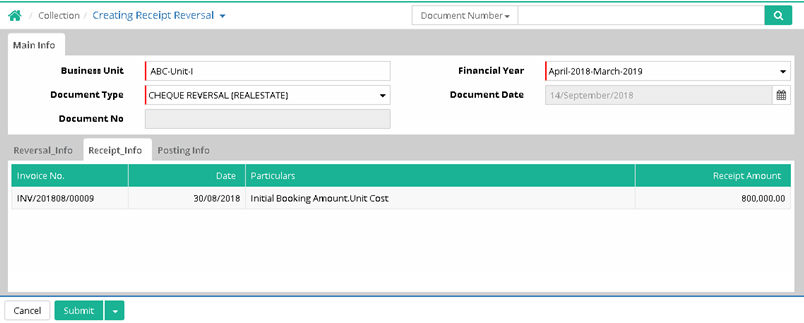

Receipt Info

This tab shows receipt details

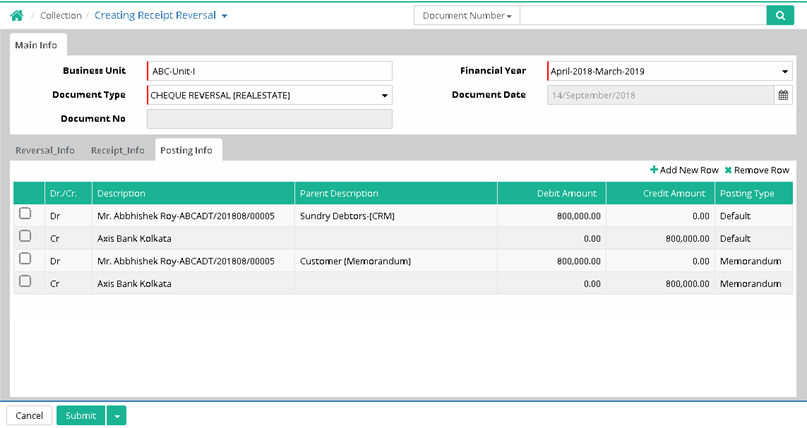

Posting Info

This tab shows account posting information

Submit and save the entry.

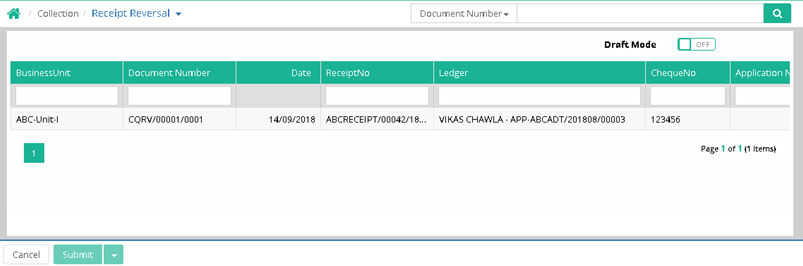

Search to view saved receipt reversal.

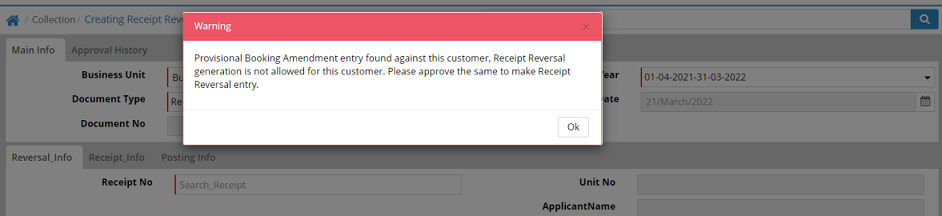

Note:

System will not allow to make any receipt reversal entry against the booking if that booking is having any provisional Booking Amendment entry and showing a validation message as shown below.

![]() Tutorial: Creating Receipt Reversal

Tutorial: Creating Receipt Reversal

© Gamut Infosystems Limited