This interface is used to create and record the details of PF (Provident Fund), ESIC, and Professional Tax applicable for the employees. Specifically, it highlights the deduction that is to be made on the salary on the grounds of these statutory policies.

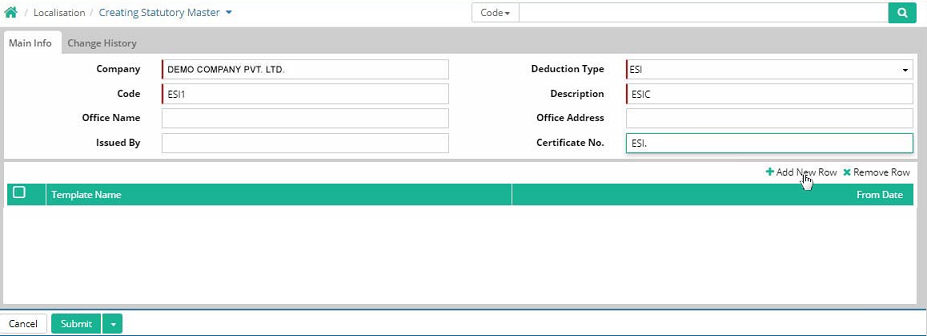

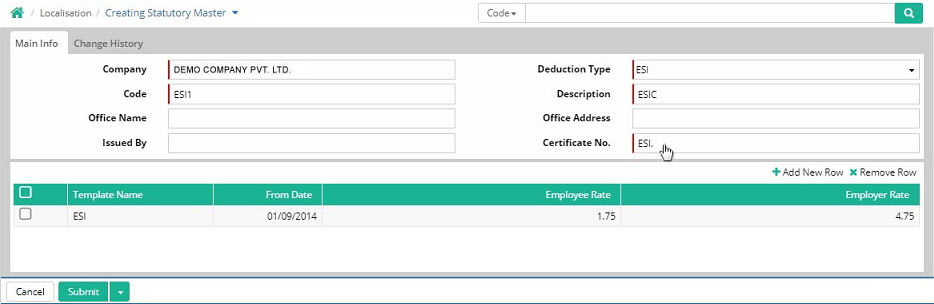

ESI Setup

Company: The name of the company where the business operations takes place has to be entered here. For example, company can be ABC Unit-1, Kolkata Unit, Delhi Unit, Ahmadabad unit, etc.

Code: It is short coded name for the item that is used here which can either be alphabetical or alphanumeric one. An abbreviated code for the ESI is to be entered here. For example, for this interface the code used can be ESI1, ESI, ESI2, ESI001, etc. (Note: If the specific code is searched, description will be auto populated and vice versa). However, the restricted limit for the code is 60 (sixty) characters. The code has to be entered in between this restricted limit, which cannot exceed.

Description: An explanation for the name of the item will be entered here. Description can be different according to the convenience. When the code is entered, description will be auto generated and vice versa (Mandatory). For example, ‘ESIC’ has been used for the code ‘ESI1’

Office name: The name of the office where the deduction will be done has to be entered here.(Optional)

Issued By: The name of the authority or person by whom, this statutory deduction have been issued has to be entered here.(Optional)

Office address: The detailed address of the office where the deduction will be procured has to be entered here.(Optional)

Deduction type: The type of deduction in salary needed for the entry has to be selected from the pre-defined drop down list containing the statutory deduction such as PF, ESI and professional tax. For example, ESI has been selected here.

Certificate no: The name of the certificate registered for the deduction policy has to be entered here. For example, ‘ESL.’ has been used here.

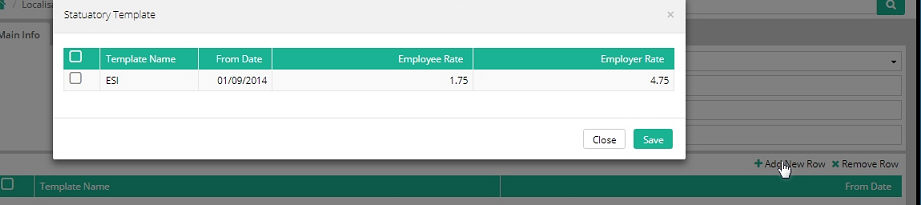

Add New Row

'+Add New Row' is clicked to select statutory template.

Click 'Save'.

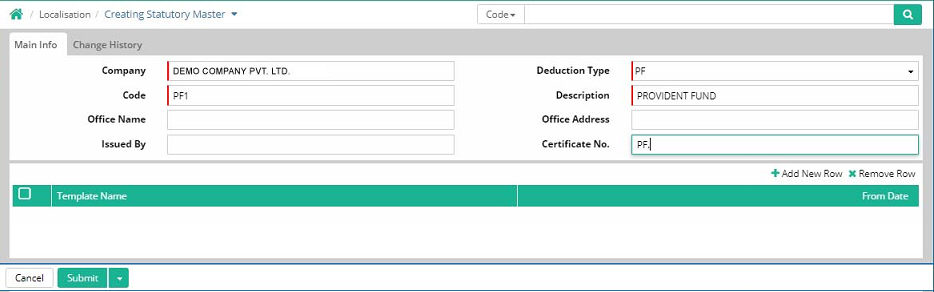

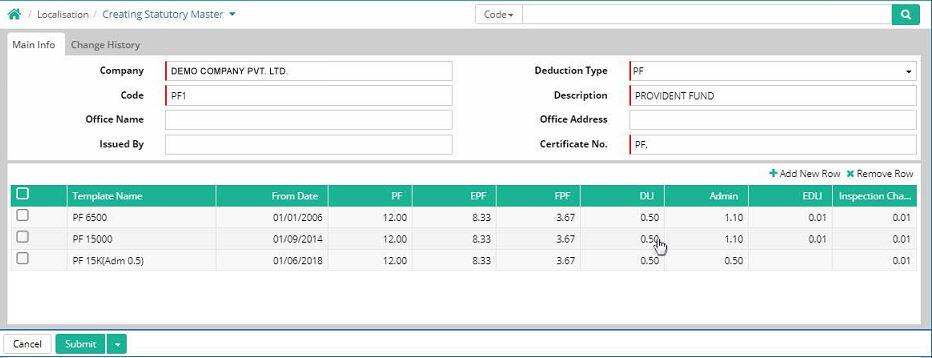

Provident Fund Setup

Company:The name of the company where the business operations takes place has to be entered here. For example, company can be ABC Unit-1, Kolkata Unit, Delhi Unit, Ahmadabad unit, etc.

Code: It is short coded name for the item that is used here which can either be alphabetical or alphanumeric one. An abbreviated code for the item is to be entered here. For example, for this interface the code used can be PF1, PF, PF2, PF001, etc. (Note: If the specific code is searched, description will be auto populated and vice versa). However, the restricted limit for the code is 60 (sixty) characters. The code has to be entered in between this restricted limit, which cannot exceed.

Description: An explanation for the name of the item will be entered here. Description can be different according to the convenience. When the code is entered, description will be auto generated and vice versa (Mandatory). For example, ‘PROVIDENT FUND’ has been used for the code ‘PF1’

Office name: The name of the office where the deduction will be done has to be entered here. (Optional)

Issued By: The name of the authority or person by whom, this statutory deduction have been issued has to be entered here. (Optional)

Office address: The detailed address of the office where the deduction will be procured has to be entered here. (Optional)

Deduction type: The type of deduction in salary needed for the entry has to be selected from the pre-defined drop down list containing the statutory deduction such as PF, ESI and professional tax. For example, PF has been selected here.

Certificate No: The name of the certificate registered for the deduction policy has to be entered here. For example, ‘PF.’ has been used here.

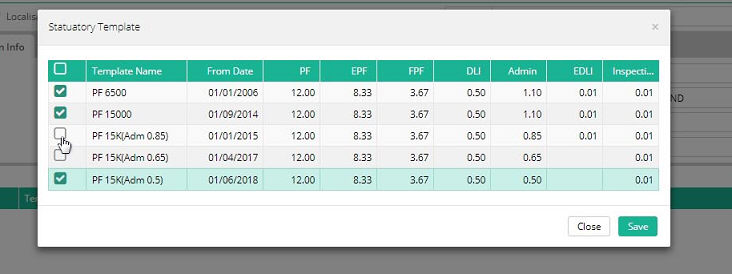

Add New Row

'+Add New Row' is clicked to select statutory template.

Click 'Save'.

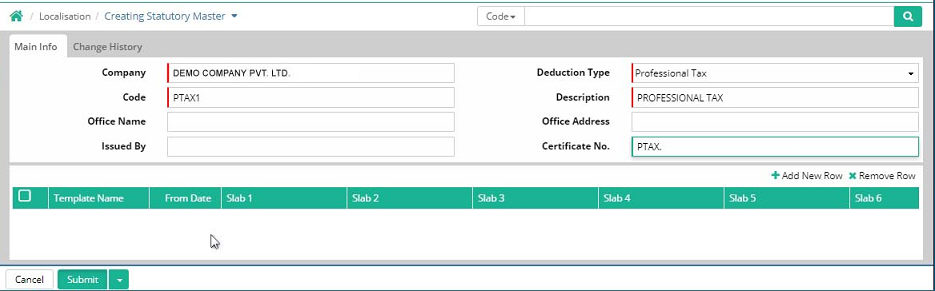

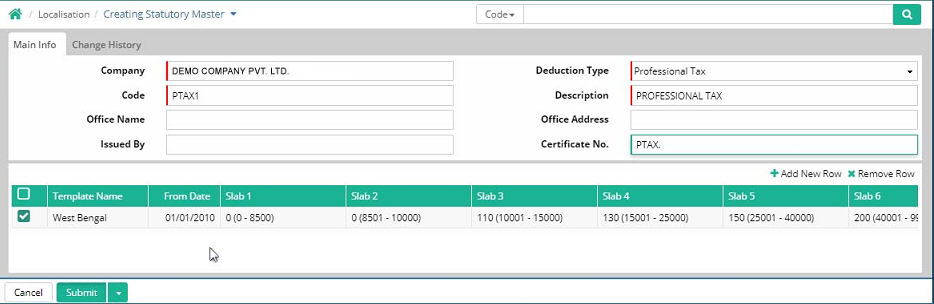

Professional Tax Setup

Company:The name of the company where the business operations takes place has to be entered here. For example, it can be ABC Unit-1, Kolkata Unit, Delhi Unit, Ahmadabad unit, etc.

Code: It is short coded name for the item that is used here which can either be alphabetical or alphanumeric one. An abbreviated code for the item is to be entered here. For example, for this interface the code used can be PTAX1, PTAX, PTAX2, PTAX001, etc. (Note: If the specific code is searched, description will be auto populated and vice versa). However, the restricted limit for the code is 60 (sixty) characters. The code has to be entered in between this restricted limit, which cannot exceed.

Description: An explanation for the name of the item will be entered here. Description can be different according to the convenience. When the code is entered, description will be auto generated and vice versa (Mandatory). For example, ‘PROFESSIONAL TAX’ has been used for the code ‘PTAX1’

Office name: The name of the office where the deduction will be done has to be entered here. (Optional)

Issued By: The name of the authority or person by whom, this statutory deduction have been issued has to be entered here. (Optional)

Office address: The detailed address of the office where the deduction will be procured has to be entered here. (Optional)

Deduction type: The type of deduction in salary needed for the entry has to be selected from the pre-defined drop down list containing the statutory deduction such as PF, ESI and professional tax. For example, Professional tax has been selected here.

Certificate No: The name of the certificate registered for the deduction policy has to be entered here. For example, ‘PTAX.’ has been used here.

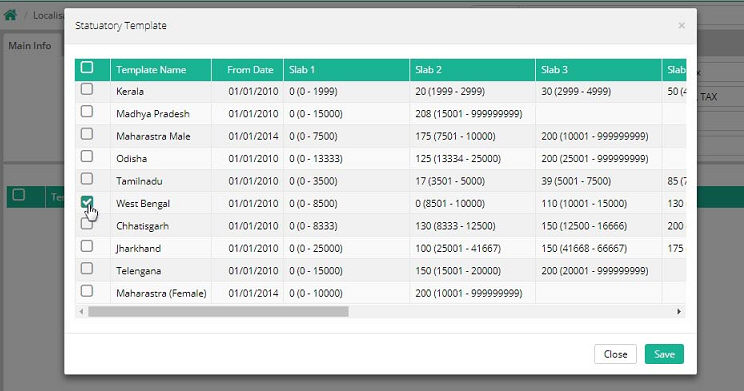

Add New Row

'+Add New Row' is clicked to select statutory template.

Click 'Save'.

© Gamut Infosystems Limited