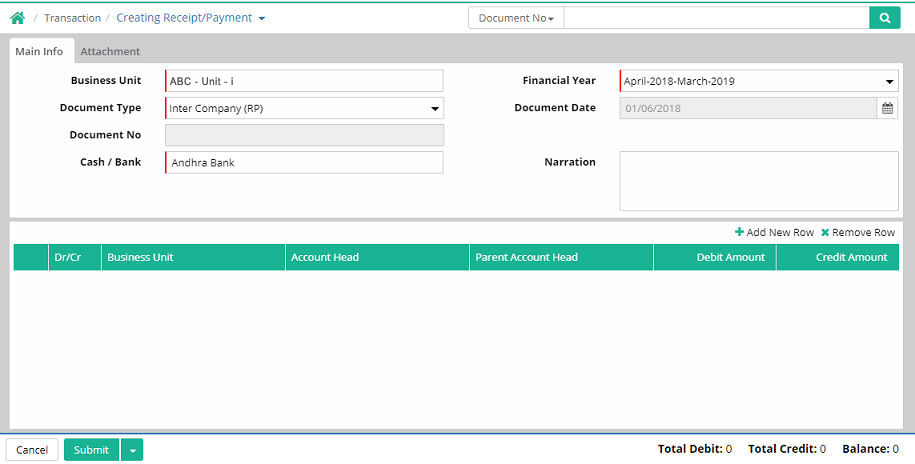

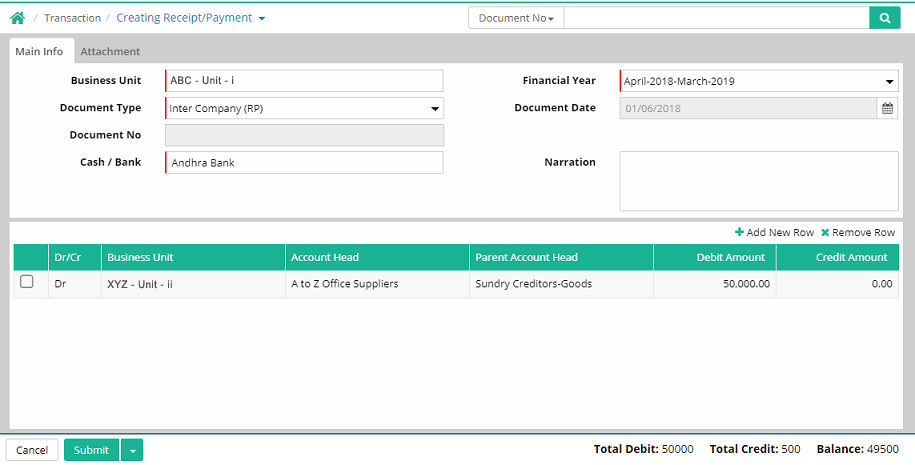

Inter Company Receipt/Payment is required for Cash/Bank entry within two or more Companies

Business Unit: User has to select the Business Unit where the receipt/payment entry will be done, which comes from Business unit organizer (Administration > Company > Business unit organizer)

Financial Year: Select financial year

Document Type: Only 'Document Type' will have to be created under category 'Inter Company (RP)'.

In order to create document type, user needs to select the pre-defined category from ‘Category’ drop down menu in ‘Document Type’ interface. User can create document types as per choice and convenience through Administration > Company > Document Type.

Document Date: Specify the document date.

Cash/Bank: Cash Account or Bank Account has to be selected as per requirement. This Cash Account/Bank Account comes from Finance > Setup > Account Head master where type is mentioned as Cash or Bank.

Narration: Enter a short description about the Inter Company Receipt/Payment entry

Click '+ Add New Row', the following section will open.

A. Routing Info

'Business Unit' has to be selected on behalf of which the receipt/payment will be made. Select 'Prefix'.

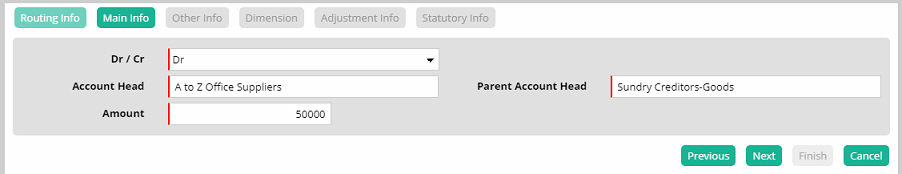

B. Main Info

Dr./Cr.: On the basis requirement, select any of the options including debit and credit.

Account Head: Select the account head.

Parent Account Head: Search and select the parent account head. If Account Head is of Sub-Ledger type, then Parent Account Head has to be selected. In selection drop down, those Parent Account Heads will be displayed which is directly related to the selected Account Head along with all other Account Heads which are marked as same as to that base Parent Account.

Amount: Enter the amount.

Click 'Next'. The 'Other Info' section will open.

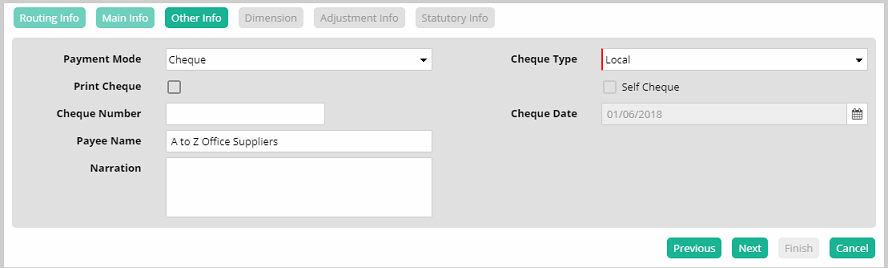

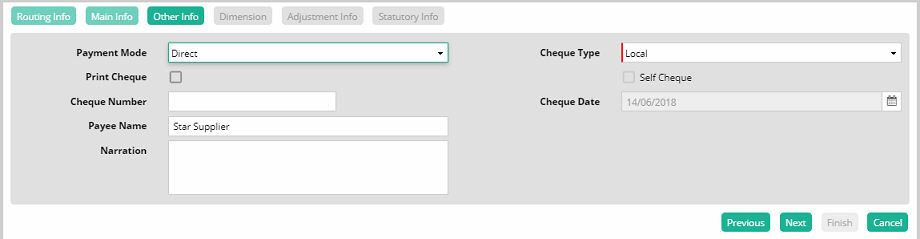

C. Other Info

Other info section is used to furnish payment related information.

Payment Mode: Payment can happen through Cheque, Demand Draft, Pay Order, Cash, Net Banking, Credit Card, RTGS, NEFT, ECheque and Direct.

1. Payment Mode - Cheque:

Cheque Type: Select cheque type as local or outstation

Print Cheque: To Print the Cheque through system, this option will be selected. If this is selected then 'Cheque Number' and 'Cheque Date' will be disabled (which will be updated after the successful cheque printing).

Cheque Number: If 'Print Cheque' is not selected then cheque number is required to be entered manually

Cheque Date: If 'Print Cheque' is not selected then cheque date is required to be entered manually

Payee Name: Select the payee name (which will be printed on Cheque)

Narration: Put detail purpose of this entry

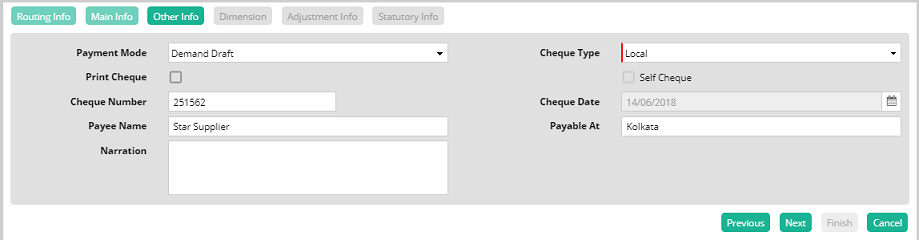

2. Payment Mode - Demand Draft:

Cheque Type: Select cheque type as local or outstation

Print Cheque: To Print the Cheque through system, this option will be selected. If this is selected then 'Cheque Number' and 'Cheque Date' will be disabled (which will be updated after the successful cheque printing).

Cheque Number: If 'Print Cheque' is not selected then cheque number is required to be entered manually

Cheque Date: If 'Print Cheque' is not selected then cheque date is required to be entered manually

Payee Name: Select or enter the payee name

Payable At: Enter the place of payment

Narration: Put detail purpose of this entry

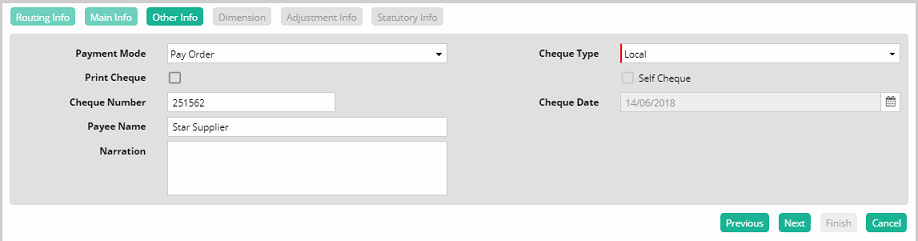

3. Payment Mode - Pay Order:

Cheque Type: Select cheque type as local or outstation

Print Cheque: To Print the Cheque through system, this option will be selected. If this is selected then 'Cheque Number' and 'Cheque Date' will be disabled (which will be updated after the successful cheque printing).

Cheque Number: If 'Print Cheque' is not selected then cheque number is required to be entered manually

Cheque Date: If 'Print Cheque' is not selected then cheque date is required to be entered manually

Payee Name: Select the payee name (which will be printed on Cheque)

Narration: Put detail purpose of this entry

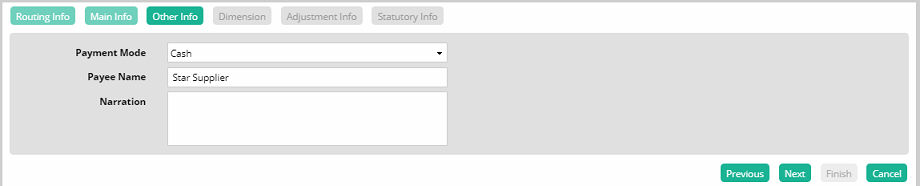

4. Payment Mode - Cash:

Payee Name: Select or enter payee name

Narration: Put detail purpose of this entry

5. Payment Mode - Net Banking:

Payee Name: Select or enter payee name

Ref Number: Enter payment reference number

Ref Date: Enter payment reference date

Narration: Put detail purpose of this entry

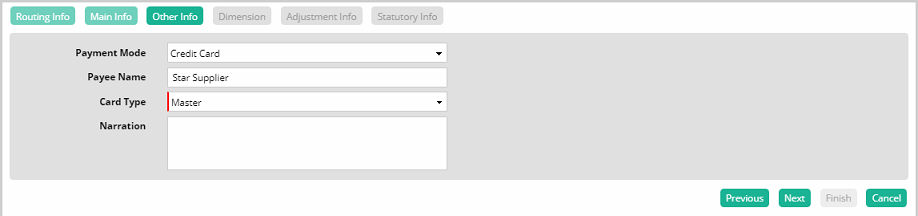

6. Payment Mode - Credit Card:

Payee Name: Select or enter payee name

Card Type: Select card type (Visa / Master etc.)

Card Type selection is mandatory in case of payment through credit card.

Narration: Put detail purpose of this entry

7. Payment Mode - RTGS:

Cheque Type: Select cheque type as local or outstation

Print Cheque: Cheque print option is required to print the cheque through system which will be sent to Drawee Bank as an instruction of Payment

Payee Name: Select or enter the payee name

Ref Number: Enter RTGS Reference number

Ref Date: Enter RTGS Reference date

Narration: Put detail purpose of this entry

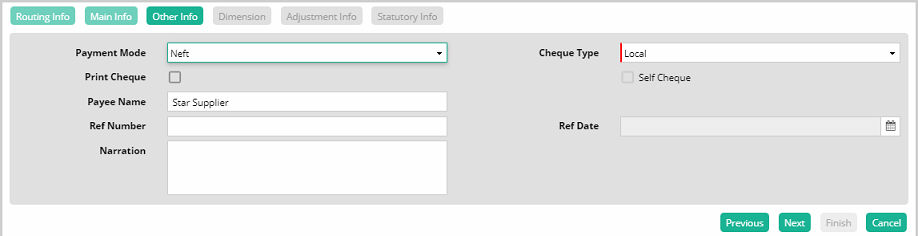

8. Payment Mode - NEFT:

Cheque Type: Select cheque type as local or outstation

Print Cheque: NEFT Cheque can be printed for sending to the bank through selecting this option

Payee Name: Select or enter the payee name

Ref Number: Enter NEFT Reference number

Ref Date: Enter NEFT Reference date

Narration: Put detail purpose of this entry

9. Payment Mode - E Cheque:

Cheque Type: Select cheque type as local or outstation

Print Cheque: E Cheque can be printed at stationary branch as per the discretion of bank

Cheque Number: If 'Print Cheque' is not checked then cheque number is required to be entered manually

Cheque Date: If 'Print Cheque' is not checked then cheque date is required to be entered manually

Payee Name: Select or enter payee name

Print Location: Select print location. It implies the branch of the bank where E Cheque will be printed

Narration: Put detail purpose of this entry

User is also able to print cheque

10. Payment Mode - Direct:

Cheque Type: Select cheque type as local or outstation

Print Cheque: Cheque for direct payment can be printed as it is required to submit to some of the banks

Cheque Number: If 'Print Cheque' is not checked then cheque number is required to be entered manually

Cheque Date: If 'Print Cheque' is not checked then cheque date is required to be entered manually

Payee Name: Select or enter payee name

Narration: Put detail purpose of this entry

C. Dimension

For construction related payment dimension

Sub Project: Select the name of the Sub Project (Sub Projects come from Engineering > Activity Management)

Budget: Select budget name (Budget comes from Engineering > Budgeting)

Zone: Select zone of the sub project (Zones come from Administration > Setup)

Milestone: Type the milestone for the payment

Tower: Type the name of the tower

Segment: Select the segment (Segments come from Administration > Setup)

SubContractor: Select the Sub Contractor (Sub Contractor come from Finance > Setup > Account Head Master)

Parent SubContractor: Select Parent Sub Contractor

For employee related payment dimension

Zone: Select zone of the sub project (Zones come from Administration > Setup)

Segment: Select the segment (Segments come from Administration > Setup)

Department: Select the department (Departments come from Payroll Master)

Employee: Select the name of the employee (Name of the employees come from Payroll Master)

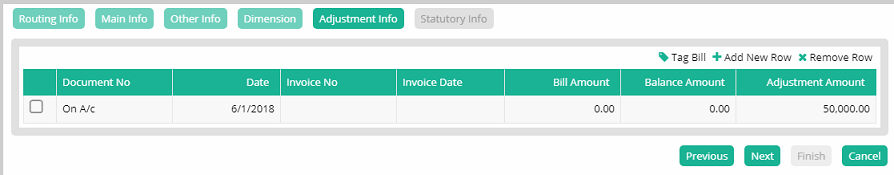

D. Adjustment Info

Under 'Adjustment Info', Bill Wise or On A/c payment can be done.

1. Bill Wise Payment

Click '+Add New Row' and select 'Bill Wise' in 'Type' drop down.

2. On A/c Payment

Click '+Add New Row' and select 'On A/c' in 'Type' drop down.

Enter 'Adjustment Amount' and click 'Save'.

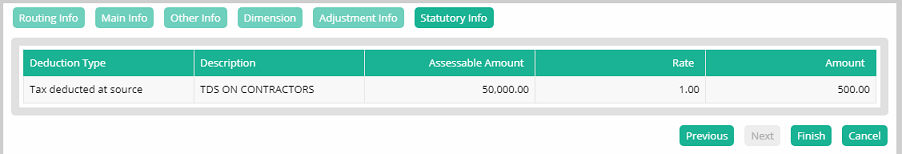

E. Statutory Info

Under 'Statutory Info' the TDS deduction details are displayed with deduction type, description, assessable amount, rate and amount.

Click 'Finish'. The Inter Company Receipt/Payment entry gets completed. Now save the entry.

Click ‘Submit’ to stay in the form and make another entry.

Click ‘Save & Close’ to save the entry and exit from the interface.

![]() Tutorial: Creating

Inter Company Receipt/Payment

Tutorial: Creating

Inter Company Receipt/Payment

© Gamut Infosystems Limited